A Practical Compliance Guide for Food Packaging Buyers

Quick Summary

Plastic bans in Southeast Asia are often misunderstood as absolute prohibitions. In reality, countries like Thailand, Malaysia, and Vietnam are pursuing selective, phased plastic reduction strategies shaped by local infrastructure, food safety needs, and economic realities. This article explains how plastic regulations actually work in these three markets, what types of food packaging are affected, and how packaging buyers can remain compliant without unnecessary material switching or cost escalation.

Southeast Asia: Why Plastic Policy Cannot Be Copy-Pasted from Europe

Southeast Asia occupies a unique position in the global plastic debate. The region combines high consumption of single-use plastics, fast-growing food delivery markets, and uneven waste management infrastructure. While public awareness of plastic pollution is rising, most countries cannot simply replicate European-style blanket bans without creating unintended consequences.

Unlike the EU, where recycling and composting systems are relatively mature, many Southeast Asian countries still rely on informal waste collection and landfill disposal. In this context, eliminating plastic does not automatically reduce environmental impact. Compostable materials often end up in landfills, and fiber-based alternatives may increase water and energy consumption upstream.

As a result, plastic regulation in Southeast Asia focuses less on material elimination and more on usage control, recyclability, and gradual transition.

What “Plastic Ban” Really Means in Southeast Asia

The term “plastic ban” is misleading when applied to Southeast Asia. Most policies fall into three practical categories:

1. Product-Specific Restrictions

Governments prioritize items with high litter rates and low reuse value, such as:

-

Lightweight plastic shopping bags

-

Plastic straws and stirrers

-

Disposable cutlery in selected contexts

2. Usage Controls and Charges

Instead of banning plastic outright, many jurisdictions require retailers to:

-

Charge for plastic bags

-

Reduce free distribution

-

Promote consumer behavioral change

3. Reduction Targets and Responsibility Frameworks

Policies increasingly require:

-

Gradual volume reduction

-

Improved recyclability

-

Material transparency

Importantly, food contact packaging—especially rigid trays, containers, and cups—remains largely regulated rather than prohibited.

Plastic Reduction vs. Plastic Replacement

One critical policy distinction often overlooked is the difference between reducing plastic use and replacing plastic materials.

In many Southeast Asian countries, replacing plastic with compostable or fiber-based materials does not guarantee environmental benefits due to limited composting infrastructure. For this reason, policymakers are increasingly supportive of:

-

Recyclable mono-material plastics

-

Lightweight packaging designs

-

Improved waste collection compatibility

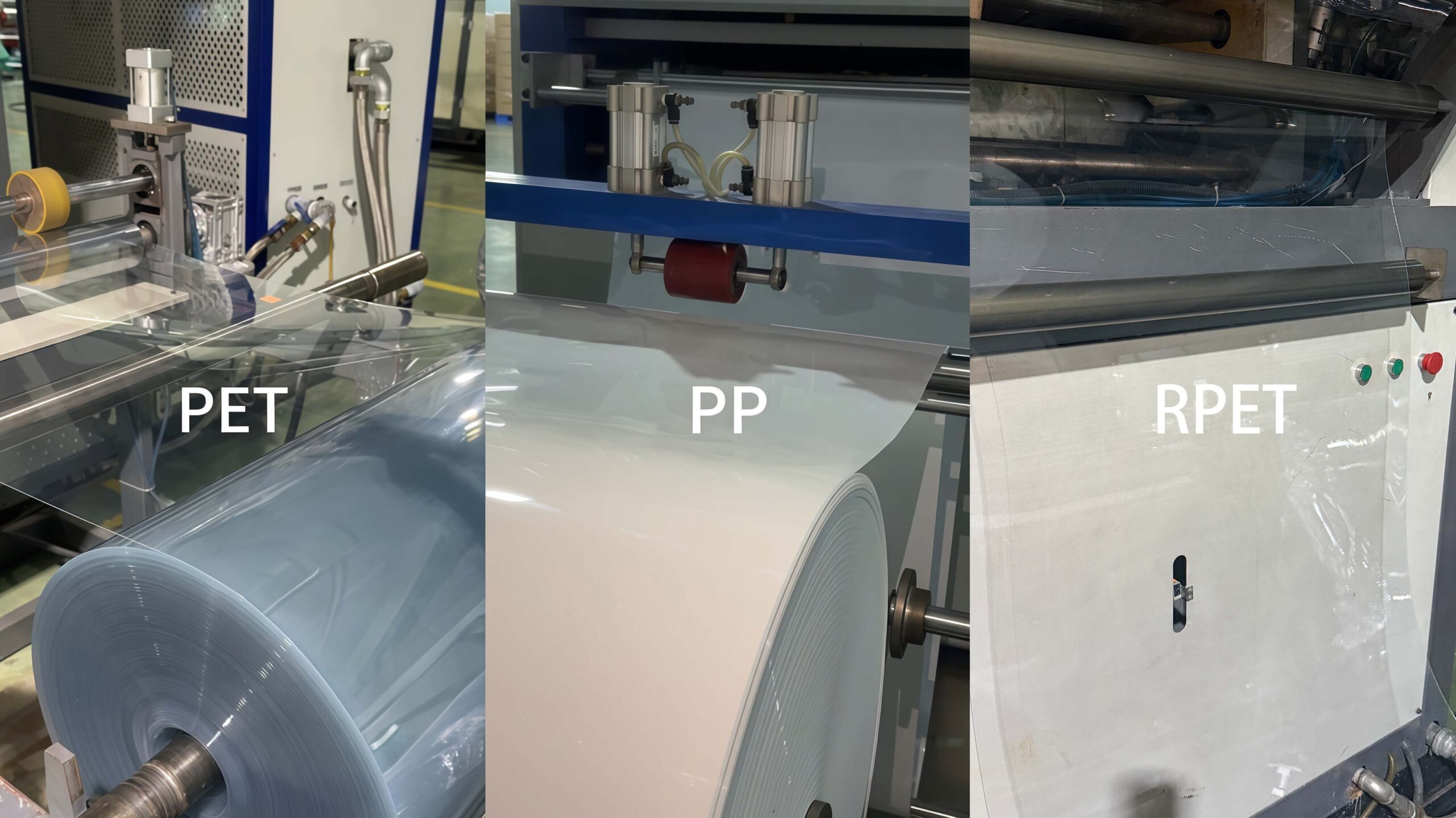

This explains why PET, rPET, and PP continue to play a central role in food packaging across the region.

Thailand Plastic Ban Explained

Click to view articles related to Thailand’s 2025 single-use food packaging policy.

Thailand’s Policy Approach: Gradual and Market-Oriented

Thailand’s plastic policy is guided by its national Plastic Waste Management Roadmap, which emphasizes long-term system improvement over immediate prohibition. Rather than imposing hard bans, Thailand relies on voluntary retailer participation and phased restrictions.

Major milestones include:

-

Nationwide reduction of ultra-thin plastic bags at large retailers

-

Restrictions on selected disposable items such as straws and stirrers

-

Long-term goals focused on recyclability and circular economy alignment

Why Thailand Avoids a Hard Ban on Food Packaging Plastics

Thailand’s food service ecosystem is heavily dependent on takeaway and delivery, particularly in urban centers and tourist destinations. Sudden restrictions on food packaging plastics could disrupt small vendors and increase food safety risks.

As a result:

-

Food-grade plastic packaging remains widely permitted

-

Compliance focuses on material safety and recyclability

-

Import restrictions on food packaging plastics are minimal

From an industry perspective, Thailand favors practical improvement over symbolic bans.

Malaysia Plastic Regulations: Why Enforcement Feels Fragmented

State-Level Authority Shapes Policy Reality

Malaysia’s plastic regulations differ significantly by state and municipality. While national roadmaps set direction, enforcement authority largely rests with local governments. This results in uneven implementation across the country.

Common regulatory measures include:

-

Plastic bag charges rather than bans

-

Voluntary reduction programs

-

Public awareness campaigns

Enforcement Reality for Packaging Buyers

For importers and brands, Malaysia’s biggest challenge is not legality but predictability. A packaging format accepted in one state may face scrutiny in another, even when no national ban exists.

Experienced packaging suppliers operating in Malaysia often emphasize:

-

Clear material labeling

-

Avoidance of unsupported environmental claims

-

Flexible packaging portfolios adaptable to local guidance

Malaysia’s regulatory risk lies more in interpretation variance than sudden nationwide policy shifts.

Vietnam Plastic Ban: The Most Aggressive Timeline in the Region

Vietnam’s Strategic Motivation

Vietnam’s plastic reduction strategy reflects broader economic ambitions. As a major export-oriented manufacturing hub, Vietnam increasingly aligns its environmental standards with international expectations, particularly those of the EU.

National policies introduce:

-

Mandatory reduction targets for businesses

-

Clear timelines for limiting single-use plastics

-

Stronger enforcement mechanisms than neighboring countries

Increasing Scrutiny on Food Packaging

While food packaging is not universally banned, it faces growing attention, especially in:

-

Supermarkets

-

Urban food service chains

-

Export-facing businesses

Suppliers serving Vietnam are expected to demonstrate:

-

Recyclability

-

Material compliance documentation

-

Credible sustainability positioning

Vietnam’s policies signal long-term structural change, not temporary campaigns.

Thailand vs Malaysia vs Vietnam: Regulatory Comparison

| Aspect | Thailand | Malaysia | Vietnam |

|---|---|---|---|

| Policy strictness | Moderate | Low–Moderate | High |

| Enforcement consistency | Medium | Low | High |

| Focus on food packaging | Limited | Minimal | Increasing |

| Import restrictions | Low | Low | Moderate |

| Timeline pressure | Gradual | Flexible | Aggressive |

How Plastic Bans Affect Food Packaging Buyers

For food packaging buyers operating across Southeast Asia, plastic bans create three recurring challenges:

-

Regulatory ambiguity, especially across borders

-

Cost pressure from premature material switching

-

Supply chain instability when alternatives lack scale

A common mistake is assuming that “plastic-free” automatically equals compliant.

What Types of Food Packaging Are Least Affected

Across Thailand, Malaysia, and Vietnam, packaging formats with the lowest regulatory risk share several characteristics:

-

Mono-material construction

-

Established recycling streams

-

Lightweight, material-efficient design

-

Clear food-contact compliance

Recyclable PET and PP packaging remains widely accepted, particularly for takeaway, ready meals, and retail food.

Industry Perspective: How Packaging Suppliers Are Adapting

From DASHAN’s experience supplying food packaging to multiple Southeast Asian markets, one trend is clear: successful compliance is incremental, not radical.

Rather than eliminating plastics entirely, many buyers:

-

Optimize material thickness

-

Transition to recyclable formats before switching materials

-

Pilot alternative materials selectively

This pragmatic approach reduces risk while aligning with evolving policy direction.

Common Misunderstandings About Southeast Asia Plastic Bans

-

“Plastic is already banned everywhere.”

Most bans are selective and phased. -

“Only compostable packaging is allowed.”

Infrastructure limitations make this unrealistic. -

“Regulations are enforced uniformly.”

Local interpretation varies widely.

What Importers and Brands Should Prepare For

To remain competitive and compliant, packaging buyers should:

-

Track country-specific policy updates

-

Maintain material flexibility

-

Prepare documentation supporting recyclability and safety

-

Avoid absolute sustainability claims

Regulatory awareness is becoming a strategic procurement advantage.

FAQ

1. Is plastic completely banned in Southeast Asia?

No. Most Southeast Asian countries apply selective and phased restrictions targeting specific single-use items rather than banning all plastic products.

2. Is food packaging affected by plastic bans in Thailand, Malaysia, and Vietnam?

Food packaging is generally regulated, not prohibited. Rigid food-grade plastics such as PET and PP remain widely used, though sustainability expectations are increasing.

3. Which country has the strictest plastic regulations in Southeast Asia?

Vietnam currently has the most aggressive plastic reduction timeline, with clearer targets and stronger enforcement compared to Thailand and Malaysia.

4. Are compostable materials required under Southeast Asia plastic laws?

No. Most regulations do not mandate compostable materials, especially where industrial composting infrastructure is limited.

5. Can plastic food packaging still be imported into Southeast Asia?

Yes. Imported food packaging is generally allowed if it complies with food contact safety standards and does not fall under restricted product categories.

6. How do plastic regulations differ between Malaysia’s states?

Malaysia enforces plastic policies at the state and municipal level, leading to variations in bag charges, enforcement intensity, and local guidelines.

7. What packaging materials face the lowest regulatory risk?

Recyclable mono-material packaging, such as PET and PP containers with established recycling streams, currently faces the lowest regulatory risk.

Conclusion

Plastic bans in Southeast Asia are real, but they are neither absolute nor uniform. Thailand, Malaysia, and Vietnam each approach plastic reduction differently, shaped by local economic and environmental realities. For food packaging buyers, the goal is not to eliminate plastic overnight, but to align materials, documentation, and sourcing strategies with evolving regulations. Those who understand the nuances will adapt smoothly—without unnecessary cost or disruption.

References

-

European Commission – Plastics and Food Contact Materials

https://food.ec.europa.eu/safety/chemical-safety/food-contact-materials/plastics_en -

European Commission – Recycled Plastic Materials

https://health.ec.europa.eu -

U.S. Food & Drug Administration – Food Contact Substances

https://www.fda.gov/food/food-ingredients-packaging/food-contact-substances-fcs -

U.S. FDA – Use of Recycled Plastics in Food Packaging

https://www.fda.gov/food/food-ingredients-packaging/use-recycled-plastics-food-packaging-chemistry-considerations -

Ellen MacArthur Foundation – Plastics and Circular Economy

https://ellenmacarthurfoundation.org/topics/plastics/overview -

PlasticsEurope – Plastics Explained

https://plasticseurope.org/knowledge-hub/plastics-explained/

Copyright Statement

© 2026 Dashan Packing. All rights reserved.

This article is an original work created by the Dashan Packing editorial team.

All text, data, and images are the result of our independent research, industry experience,

and product development insights. Reproduction or redistribution of any part of this content

without written permission is strictly prohibited.

Dashan Packing is committed to providing accurate, evidence-based information and

to upholding transparency, originality, and compliance with global intellectual property standards.