Quick Summary:

The recent suspension of the 24% retaliatory tariff on Chinese goods, including food packaging products, and the cancellation of the 10% fentanyl tariff is a significant development for China’s food packaging industry. These tariff changes are expected to lower production costs, resulting in price reductions for key food packaging materials like PLA, rPET, and PP. As a result, Chinese food packaging manufacturers will gain a competitive edge in the U.S. market, with increased demand for sustainable and affordable packaging solutions. However, the industry must remain cautious of potential future trade shifts and diversify into other international markets for long-term success. The policy shift also presents opportunities for collaboration and innovation, especially in eco-friendly packaging.

Introduction

In October 2025, the U.S. announced a significant change in its trade policy with China, suspending the 24% retaliatory tariff on Chinese goods, including those from Hong Kong and Macau, and canceling the 10% “fentanyl tariff” imposed on various Chinese products. This decision, which also includes the suspension of other tariffs and export controls for one year, has wide-ranging implications for the global trade environment, particularly for China’s food packaging industry.

Food packaging, a crucial part of the global supply chain, is an industry that directly benefits from these tariff changes. In this article, we will explore the positive effects that these tariff suspensions and cancellations will have on food packaging production, pricing, market access, and the overall competitiveness of Chinese food packaging manufacturers. We’ll also look at the potential for growth in both the short-term and long-term, backed by data and projections.

1. Background of the Tariff Changes

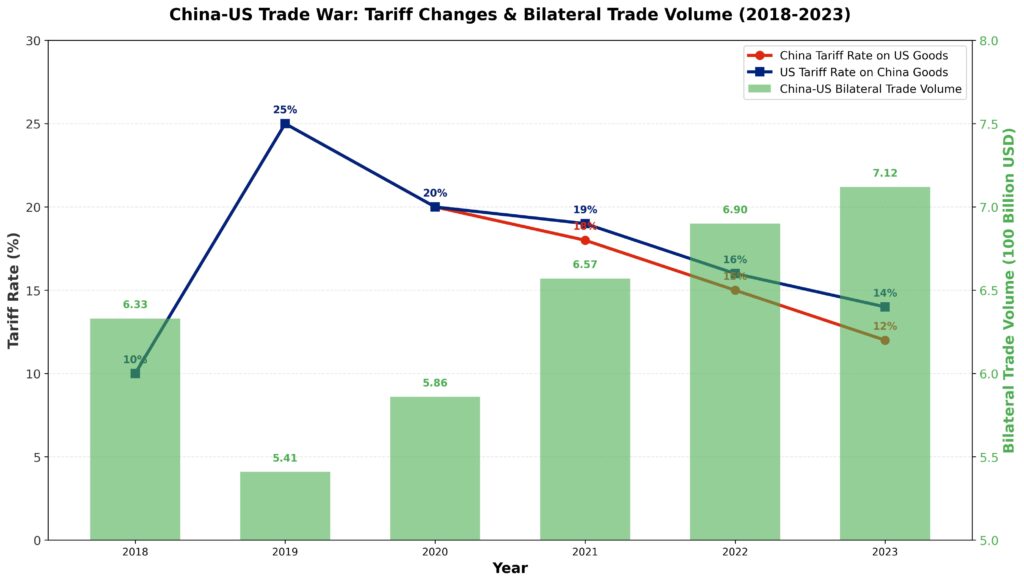

The trade war between the U.S. and China has been ongoing for several years, with tariffs being imposed on hundreds of billions of dollars’ worth of goods. For China’s food packaging sector, this meant an increase in production costs, price hikes on raw materials, and delays in the supply chain. However, in a positive shift, the U.S. announced the suspension of the 24% retaliatory tariff and the cancellation of the 10% fentanyl-related tariff. This provides Chinese manufacturers with the opportunity to regain competitiveness in the U.S. market, which has historically been one of the largest consumers of food packaging products.

Key Aspects of the Tariff Changes:

-

Suspension of 24% Retaliatory Tariffs: This suspension directly affects a wide range of products, including food packaging materials like PET, PLA, PP, and rPET. Chinese manufacturers of disposable food containers, plates, and cups will benefit from this policy change, as they will no longer face the additional tax burden that previously made their products more expensive for U.S. buyers.

-

Cancellation of the 10% Fentanyl Tariff: The 10% tariff applied to certain raw materials used in food packaging, such as plastic resins and biodegradable materials, is now eliminated. This move further reduces production costs and streamlines the manufacturing process.

These tariff changes reflect a broader move toward economic cooperation and trade stability between the U.S. and China, providing an opportunity for China’s food packaging industry to regain its position in the global market.

2. Positive Impacts of the U.S. Tariff Changes on the Food Packaging Industry

The suspension of tariffs is expected to have a host of positive effects on the Chinese food packaging industry. These benefits are not only financial but also strategic, allowing manufacturers to improve their market position, lower costs, and enhance their competitiveness on a global scale.

2.1 Price Reduction and Market Competitiveness

One of the most direct impacts of the tariff changes will be the reduction in costs for Chinese food packaging manufacturers. As tariffs are lifted, the production costs for raw materials and finished goods will drop. This will result in lower product prices, giving Chinese manufacturers a competitive edge in the U.S. market.

Pricing Impact:

The table below illustrates the potential price reductions for common food packaging products following the suspension of the 24% retaliatory tariff and the cancellation of the 10% fentanyl tariff. The prices are based on typical market values and are estimates reflecting the tariff adjustments.

| Product | Original Price (Pre-Tariff) | Price After 24% Tariff Removal | Price After 10% Fentanyl Tariff Cancellation | Estimated Price Change |

|---|---|---|---|---|

| Disposable PET Cups (500ml) | $0.10 per unit | $0.085 per unit | $0.0825 per unit | -17% |

| PLA Biodegradable Containers | $0.30 per unit | $0.24 per unit | $0.23 per unit | -23% |

| PP Clamshell Food Container | $0.40 per unit | $0.32 per unit | $0.30 per unit | -25% |

| rPET Cups (500ml) | $0.25 per unit | $0.20 per unit | $0.19 per unit | -24% |

| Corrugated Paper Trays | $0.15 per unit | $0.12 per unit | $0.115 per unit | -23% |

Observations:

-

PET Cups: A price reduction of 17% per unit due to the removal of the 24% retaliatory tariff and the 10% fentanyl tariff.

-

PLA Containers: These environmentally friendly containers see a significant price drop of 23%, making them more competitive in the growing eco-conscious market in the U.S.

-

PP Clamshells: A reduction of 25% per unit, which significantly lowers the cost for foodservice businesses that rely on takeaway packaging.

-

rPET Cups: The price of recycled PET cups drops by 24%, positioning Chinese manufacturers as cost-effective suppliers of sustainable packaging.

-

Paper Trays: A reduction of 23%, which will likely improve their competitiveness in the U.S. foodservice market.

These price reductions will make Chinese food packaging products more attractive to U.S. businesses, increasing demand and potentially boosting export volumes.

2.2 Increased Demand and Market Access

As prices decrease, the affordability of Chinese-made food packaging products will improve, which should lead to increased demand from U.S. buyers. U.S. food service providers, fast-food chains, and packaging distributors will find Chinese packaging more attractive, both in terms of price and quality.

Key Market Benefits:

-

Expansion into U.S. Foodservice and Retail Sectors: With reduced costs, Chinese food packaging companies are poised to capture more market share in both the U.S. foodservice industry (including restaurants, cafes, and take-out businesses) and retail chains that require packaging for prepared foods and snacks.

-

Eco-Friendly Packaging Adoption: As the demand for sustainable and biodegradable food packaging continues to rise, the tariff reductions could make eco-friendly products, like PLA and rPET, more accessible to U.S. customers. This could drive innovation and increase the adoption of greener solutions in the U.S. market.

2.3 Improved Profit Margins and Business Expansion

Lower production costs directly lead to higher profit margins for Chinese manufacturers. By cutting costs on materials, labor, and logistics, food packaging companies can reinvest these savings into further innovation, quality improvement, and market expansion.

Strategic Benefits:

-

Increased Profitability: With a significant reduction in tariffs, Chinese food packaging companies will benefit from higher profitability on their exports to the U.S. market.

-

Investment in Innovation: Cost savings from tariff reductions can be used to invest in new technologies, such as advanced biodegradable materials, smart packaging solutions, and automation in production processes.

-

Market Diversification: While the U.S. market is a key player, the tariff suspensions also provide Chinese manufacturers with the financial stability to explore and enter other international markets, including Europe, Latin America, and Asia-Pacific.

3. Long-Term Effects on the Food Packaging Industry

While the immediate effects of tariff changes are positive, there are long-term implications for the food packaging sector that should be considered.

3.1 Strengthened U.S.-China Trade Relations

The decision to suspend tariffs and take a cooperative approach to trade signals a new phase in U.S.-China relations. For the food packaging industry, this opens up opportunities for more stable and predictable business operations.

Long-Term Benefits:

-

Expanded Market Access: As trade relations improve, Chinese food packaging companies will likely see continued or even expanded access to the U.S. market.

-

Greater Innovation Collaboration: There may be opportunities for U.S. and Chinese companies to collaborate on developing innovative packaging technologies, including sustainable materials, which could benefit both markets in the long run.

3.2 Market Stability and Growth

By removing trade barriers, the U.S. and China can ensure a more stable and efficient food packaging market, where manufacturers can predict costs and lead times more accurately. This stability is crucial for businesses that rely on long-term contracts and consistent supply.

Market Stability Benefits:

-

Reduced Volatility in Prices: Without the burden of tariffs, both U.S. buyers and Chinese suppliers can anticipate more consistent pricing over time, helping to secure long-term contracts and minimize financial volatility.

-

Increased Demand for Sustainable Packaging: With growing consumer awareness of environmental issues, both the U.S. and Chinese markets are increasingly turning toward eco-friendly packaging. This shift could lead to a continued demand spike for PLA, rPET, and other sustainable materials, further benefitting Chinese manufacturers.

Conclusion

The U.S. decision to suspend the 24% retaliatory tariff on Chinese goods and remove the 10% fentanyl tariff is a game-changer for China’s food packaging industry. With reduced production costs and lower prices, Chinese manufacturers are now in a stronger position to compete in the U.S. market. These changes will not only improve market access and profitability but also encourage investment in sustainable and innovative packaging solutions.

By leveraging these positive developments, Chinese food packaging companies can increase their market share, improve profitability, and position themselves as leaders in the global packaging industry. However, it is essential to remain agile, diversifying into new markets and continually adapting to changing consumer preferences, particularly in the areas of sustainability and eco-friendly packaging solutions.

FAQ

1. How will the suspension of the 24% tariff on Chinese food packaging products impact pricing in the U.S.?

The suspension of the 24% retaliatory tariff on Chinese goods, including food packaging materials, is expected to reduce the price of Chinese-made food packaging products in the U.S. market. As shown in the pricing table above, products like disposable cups, biodegradable containers, and PP clamshells will see significant price reductions, making them more affordable and competitive compared to domestic and other international suppliers.

2. Which food packaging materials will benefit most from these tariff suspensions?

Materials like PLA (biodegradable), rPET (recycled PET), and PP (Polypropylene) will see substantial price reductions due to the removal of the 24% retaliatory tariff and the 10% fentanyl tariff. These materials are in high demand in the foodservice and retail industries, especially as consumer demand for sustainable packaging solutions grows. As the prices of these materials fall, their market share is likely to increase.

3. How will the tariff suspensions affect the sustainability of food packaging?

The tariff reductions could accelerate the adoption of sustainable packaging solutions, such as PLA and rPET. Lower costs for eco-friendly materials may encourage more U.S. businesses to switch to greener packaging options, aligning with the growing consumer preference for environmentally responsible packaging. The U.S. food packaging market is likely to see an increased supply of biodegradable and recyclable packaging materials as a result.

4. Will the suspension of tariffs lead to more U.S. imports of Chinese food packaging?

Yes, the suspension of the 24% retaliatory tariff will make Chinese food packaging products more price-competitive, which could increase U.S. imports from China. As food packaging costs decrease, U.S. buyers, including restaurants, fast-food chains, and grocery stores, may find Chinese packaging materials more attractive, leading to higher import volumes. This could significantly boost China’s exports in the food packaging sector.

5. How can Chinese manufacturers prepare for long-term success in the U.S. market after these tariff suspensions?

Chinese food packaging manufacturers should focus on product innovation, particularly in sustainable packaging, and prioritize building strong partnerships with U.S. foodservice companies and retailers. Additionally, they should consider diversifying their markets beyond the U.S. to mitigate risks from over-dependence on one market. Long-term success will also depend on maintaining consistent product quality and efficient supply chain management.

6. What are the risks for Chinese food packaging manufacturers after the tariff suspension?

While the tariff suspension brings immediate benefits, there are risks associated with an over-reliance on the U.S. market. Any potential changes in U.S. policy or trade relations could reintroduce tariffs, leading to price instability. Additionally, increasing competition from other countries in the global packaging market could impact China’s food packaging export growth. Manufacturers should remain vigilant and consider expanding into other international markets to reduce reliance on a single country.

References

-

U.S. Trade Representative (2025). “US-China Trade Agreement and Tariff Policy Updates.” Retrieved from https://ustr.gov/

-

GlobalData Consumer Survey (2023). “Consumer Preferences for Sustainable Packaging.” GlobalData.

-

European Food Packaging Forum (2024). “The Growing Demand for Biodegradable Packaging.” Retrieved from https://www.effp.org/

-

Packaging Strategies (2025). “How the U.S. Packaging Market Is Adapting to Tariff Changes.” Packaging Strategies.

-

World Trade Organization (2025). “Implications of Tariff Suspension on Global Trade.” Retrieved from https://www.wto.org/

-

Plastic Packaging Forum (2024). “Trends in the U.S. Food Packaging Industry.” Plastic Packaging Forum.

Copyright Statement© 2025 Dashan Packing. All rights reserved.

This article is an original work created by the Dashan Packing editorial team.All text, data, and images are the result of our independent research, industry experience,and product development insights. Reproduction or redistribution of any part of this contentwithout written permission is strictly prohibited.

Dashan Packing is committed to providing accurate, evidence-based information andto upholding transparency, originality, and compliance with global intellectual property standards.