The Regulatory Pressure Shaping Packaging Choices in 2025

The global food packaging industry is experiencing a dual transformation. On one side, plastic bans and sustainability mandates are accelerating. On the other, plastic packaging remains indispensable in certain markets due to performance, affordability, and established recycling systems.

-

European Union (EU): The SUP Directive bans single-use plastics like straws and cutlery, pushing EN13432-certified compostable products. However, PP and PET containers remain permitted for certain food-contact categories if recyclable.

-

United States: State-level bans in California, New York, and Washington restrict foam and polystyrene. PET cold drink cups and PP takeaway boxes are still allowed under FDA food-contact safety rules.

-

Canada: Nationwide bans target plastic checkout bags and disposable foodware, driving adoption of bagasse, PLA, and kraft containers.

-

Asia-Pacific: India, Singapore, and Japan are tightening levies on single-use plastics, but many distributors still rely on PP/PET for cost-sensitive sectors.

📌 Key takeaway: In 2025, compliance is non-negotiable. Distributors must balance plastic’s economic advantage with biodegradable’s regulatory safety.

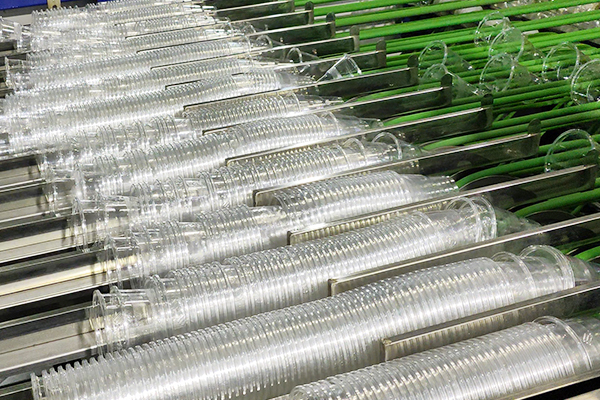

Why Plastic Still Matters for Distributors

Despite rising eco-regulations, plastic packaging remains essential for distributors in many sectors.

Cost Efficiency

-

Lower unit cost compared to biodegradable packaging.

-

Stable raw material supply ensures predictable pricing.

Performance & Safety

-

Heat resistance: PP containers can withstand up to 120°C, making them microwave-safe.

-

Barrier properties: PET packaging provides clarity, moisture resistance, and extended shelf life.

Supply Chain Reliability

-

Mass availability: Global production capacity ensures consistent supply.

-

Recycling infrastructure: PET bottles and trays are widely recycled, especially in North America and Europe.

📌 Wholesale edge: Plastic is still the go-to for price-sensitive markets, long-haul delivery, and frozen-to-oven products.

Why Biodegradable Packaging Is Winning Market Share

Biodegradable packaging is no longer a niche — it’s a strategic compliance tool.

Regulatory Compliance

-

Certified compostable packaging (EN13432, ASTM D6400) ensures smooth cross-border trade.

-

Helps distributors avoid penalties, customs rejection, and reputational risk.

Brand Value & Consumer Demand

-

70% of global consumers say they prefer eco-friendly packaging (Statista, 2024).

-

Retailers and food chains use biodegradable packaging as a marketing advantage.

Versatile Options

-

Bagasse: Leak-proof, sturdy, microwave-safe.

-

PLA & CPLA: Transparent cups and heat-resistant cutlery.

-

Kraft paper bowls: Customizable, suitable for salads and soups.

-

Cornstarch containers: Affordable and biodegradable, ideal for QSR chains.

📌 Wholesale edge: Biodegradable packaging supports sustainability goals, retail expansion, and eco-label branding.

Core Product Comparison for Distributors

| Material | Key Features | Heat Resistance | End-of-Life | Best Use Cases |

|---|---|---|---|---|

| PP (Plastic) | Microwave-safe, durable | Up to 120°C | Recyclable | Hot meals, takeout boxes |

| PET (Plastic) | Transparent, strong seal | Up to 60°C | Widely recycled | Cold drinks, fresh produce |

| Bagasse | Leak-resistant, sturdy | Up to 120°C | Compostable | Meals, trays, clamshells |

| PLA | Clear, lightweight | Up to 50°C | Compostable | Cold beverages, smoothies |

| CPLA | Heat-resistant utensils | Up to 90°C | Compostable | Cutlery, stirrers |

| Kraft Paper | Customizable, eco-look | Up to 100°C | Compostable | Salads, soups |

| Cornstarch | Plastic-like, affordable | Up to 80°C | Compostable | QSR bowls, supermarket trays |

Case Study Insights

-

U.S. Meal Kit Distributor – Hybrid Model

Adopted PP microwave-safe containers for hot meals and PLA cups for cold beverages. This reduced total costs by 8% while maintaining FDA compliance. -

European QSR Chain – Biodegradable Transition

Shifted from PET clamshells to bagasse trays and kraft salad bowls. Result: 15% increase in eco-conscious customer loyalty. -

Asian Importer – Plastic + Biodegradable Mix

Combined cornstarch food containers with PET cold cups to balance affordability and compliance with Singapore’s 2025 plastic ban.

2025 Market Outlook & Data Trends

-

Global biodegradable packaging market: $14B+ in 2025, CAGR ~14%.

-

Plastic packaging market: Still exceeds $350B, but growth slowing to 3–4%.

-

Hybrid demand rising: Distributors increasingly mix plastic and biodegradable to optimize costs and compliance.

| Region | Growth Focus | Plastic Demand | Biodegradable Demand |

|---|---|---|---|

| North America | Meal kits, supermarkets | Strong (PET/PP) | Rising (PLA, Bagasse) |

| Europe | Strict EU laws | Limited use | Strong (Kraft, CPLA) |

| Asia-Pacific | Cost-sensitive + bans | High (PP, PET) | Fastest growth (Bagasse, Cornstarch) |

How Distributors Evaluate Plastic vs. Biodegradable Suppliers

| Evaluation Area | Plastic Supplier Expectation | Biodegradable Supplier Expectation |

|---|---|---|

| Compliance | FDA food-contact, recycling labels | EN13432, ASTM D6400, BPI |

| Pricing & MOQ | Low unit price, large MOQ | Transparent tiered pricing, small MOQ pilots |

| Supply Chain | Stable global production | Stock buffering, alternative sourcing |

| Customization | Branding with IML/stickers | Eco-labels, compostability marks |

| After-Sales | Data sheets, recycling guidance | Regulatory updates, eco-marketing collateral |

Conclusion — The Hybrid Future for Distributors

In 2025, the distributor’s choice is not plastic vs. biodegradable — it is plastic and biodegradable.

-

Plastic (PP, PET): Cost-effective, reliable, high-performance for specific use cases.

-

Biodegradable (Bagasse, PLA, Kraft, Cornstarch): Compliance-ready, eco-friendly, and brand-enhancing.

Forward-looking distributors adopt hybrid sourcing strategies, securing short-term profitability while preparing for a fully sustainable future.

FAQ

1. Why do distributors still use plastic packaging in 2025?

Because PP and PET are affordable, reliable, and widely recyclable in certain markets.

2. What are the main benefits of biodegradable packaging for wholesale?

It ensures regulatory compliance, boosts brand image, and meets consumer demand for sustainability.

3. Can distributors combine plastic and biodegradable packaging?

Yes, many adopt a hybrid approach — plastic for cost-sensitive items, biodegradable for regulated or eco-marketing channels.

4. What certifications matter most for biodegradable packaging?

EN13432, ASTM D6400, BPI, TÜV OK Compost, and FDA/EU food-contact approvals.

5. Which biodegradable materials are most in demand in 2025?

Bagasse containers, PLA cups, kraft paper bowls, and cornstarch trays.

References

-

Statista – Consumer demand for sustainable packaging

https://www.statista.com/statistics/1322066/global-consumer-demand-sustainable-packaging/ -

European Commission – Single-Use Plastics Directive

https://environment.ec.europa.eu/topics/plastics/single-use-plastics_en -

US EPA – Sustainable Management of Plastics

https://www.epa.gov/smm/sustainable-management-materials-plastics -

Food Packaging Forum – Biodegradable packaging regulations

https://www.foodpackagingforum.org/fpf-2016/biodegradable-packaging -

McKinsey – Future of food packaging

https://www.mckinsey.com/industries/paper-forest-products-and-packaging/our-insights/the-future-of-packaging