✅ Quick Summary

PLA (polylactic acid) packaging is rapidly expanding in Chile and Colombia due to strong regulatory pressure, rising sustainability expectations, and government-led circular-economy plans. Chile’s strict EPR laws and single-use plastic restrictions, along with Colombia’s ambitious plastic tax and recycling targets, are accelerating the shift from PET to compostable PLA cups and containers. For global packaging suppliers, this provides a window of opportunity to enter a fast-growing South American market actively seeking certified, food-safe, and environmentally compliant alternatives.

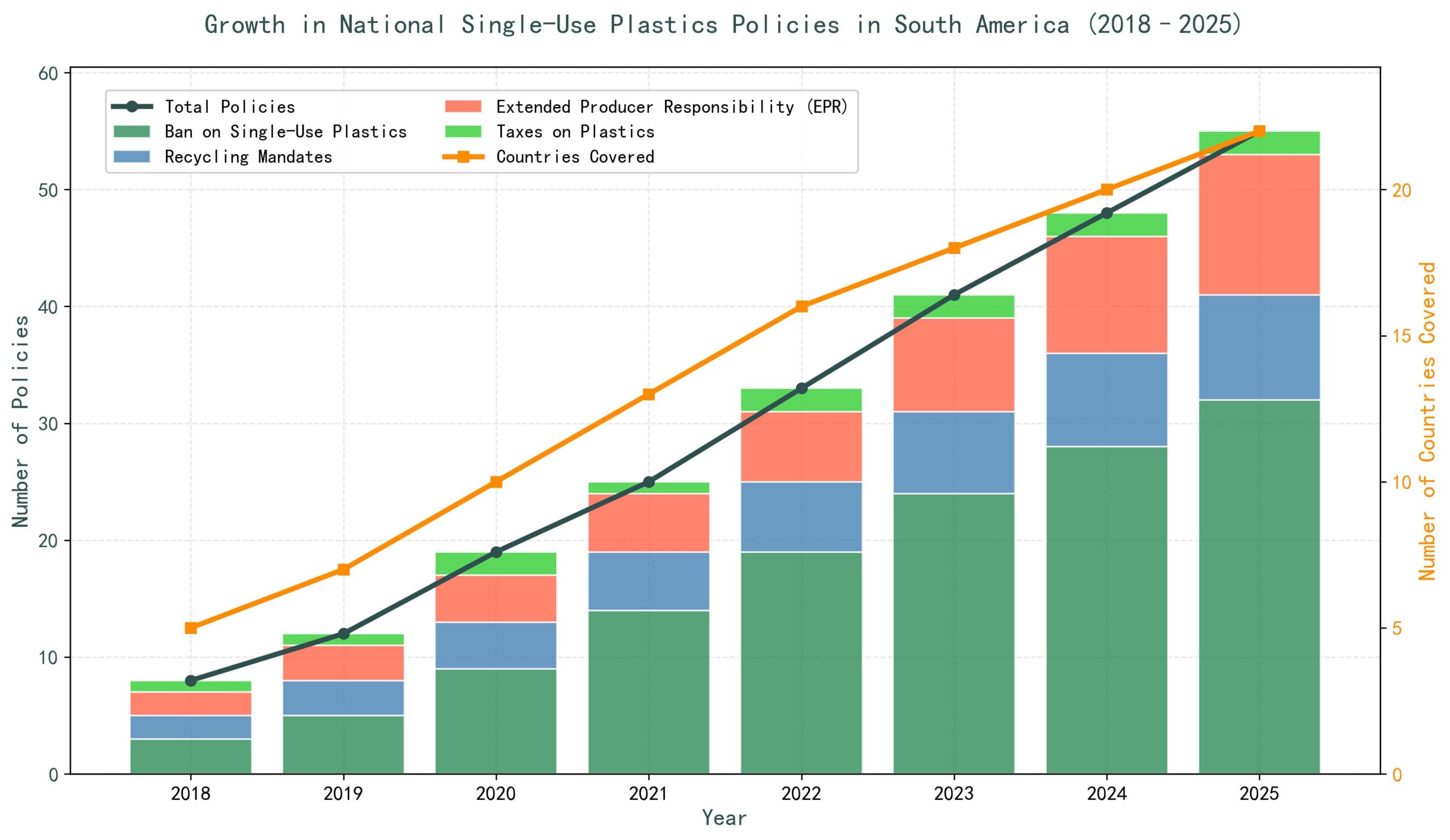

1. Introduction: South America’s Emerging Shift Toward Sustainable Packaging

Over the past decade, South America has evolved from a region primarily focused on traditional plastic use to one of the fastest-growing markets for sustainable packaging solutions. Driven by increasingly strict environmental regulations, global supply-chain pressures, and changing consumer preferences, countries such as Chile and Colombia are emerging as leaders in the transition to biobased materials—particularly PLA (polylactic acid).

While Europe and North America were historically at the forefront of bioplastic adoption, South America is now entering a phase where regulations and market demand align more closely than ever. Governments have begun prohibiting or restricting single-use plastics, especially those made from PS (polystyrene), PVC, and certain forms of PP (polypropylene). This regulatory tightening has accelerated interest in alternatives like PLA, especially in the foodservice, beverage, and takeaway sectors.

Why Chile and Colombia?

These two countries stand out in South America because they are:

-

Among the first to enact national-level bans on multiple categories of single-use plastics

-

Highly active in global environmental commitments

-

Structurally prepared to incorporate biobased alternatives into their circular-economy frameworks

-

Markets where compostable products, including PLA cups, have seen double-digit annual growth

Environmental ministries in both countries also collaborate with organizations such as the UN Environment Programme (UNEP), the OECD, and the Latin American Plastics Association (ASIPLA) to align policies with global standards.

2. Understanding PLA: Properties, Production, and Global Adoption

Before analyzing demand in Chile and Colombia, it is essential to understand PLA’s core material characteristics and why it is becoming a preferred choice for regulated markets.

2.1. What is PLA?

PLA (polylactic acid) is a biobased polyester produced primarily from fermented plant starches such as corn, sugarcane, or cassava. It is:

-

Renewable

-

Industrially compostable (under controlled conditions)

-

Transparent and rigid, similar to PET

-

Suitable for cold drinks, salad bowls, cold dessert cups, and cup lids

2.2. Key Properties of PLA Cups

2.3. Why PLA Is Growing Globally

-

EU’s SUPD (Single-Use Plastics Directive) restricts many fossil-based plastics

-

U.S. states such as California promote biobased solutions

-

Major foodservice brands (Starbucks, McDonald’s pilots) are testing PLA and compostables

3. Chile’s Regulatory Environment and Its Impact on PLA Growth

Chile is widely recognized as the most advanced country in South America in terms of plastics regulation. Its environmental policies are detailed, ambitious, and enforced with clear penalties.

3.1. Overview of Chile’s National Plastics Regulation (Law 21.368)

Chile’s Single-Use Plastics Law (SUP Law) restricts plastic products used in foodservice, especially:

-

Plastic cutlery

-

Plastic stirrers

-

Expanded polystyrene (EPS/Styrofoam) containers

-

Non-certified biodegradable plastics

Foodservice establishments, cafés, restaurants, and delivery services must comply with the restriction phases launched between 2021 and 2024.

3.2. Key Regulatory Milestones

| Year | Policy Change |

|---|---|

| 2021 | Ban on plastic straws, cutlery, stirrers |

| 2022 | EPS food containers prohibited |

| 2023 | Restrictions extended to delivery platforms |

| 2024–2025 | Nationwide shift toward reusable or certified compostable packaging |

3.3. PLA’s Role in Chile’s Packaging Transition

Because PLA is industrially compostable and recognized as a more environmentally preferable option, it meets Chile’s criteria for replacing EPS, PS, and certain PP food packaging.

PLA has been adopted widely for:

-

Cold drink cups in cafés

-

Juice bars and smoothies

-

Salad bowls in supermarkets

-

Food delivery platforms (e.g., Rappi, PedidosYa)

Chile also has one of the region’s strongest composting infrastructures, with industrial composting facilities in:

-

Santiago

-

Valparaíso

-

Concepción

3.4. Challenges in Chile

-

Composting facilities still insufficient outside major cities

-

Public understanding of “industrial composting only” is limited

-

Higher PLA costs challenge small foodservice businesses

Authority Sources Suggested

-

Ministerio del Medio Ambiente de Chile

-

Chile’s Plastic Pact (2022–2024 reports)

-

UN Environment Programme (UNEP) Latin America Office

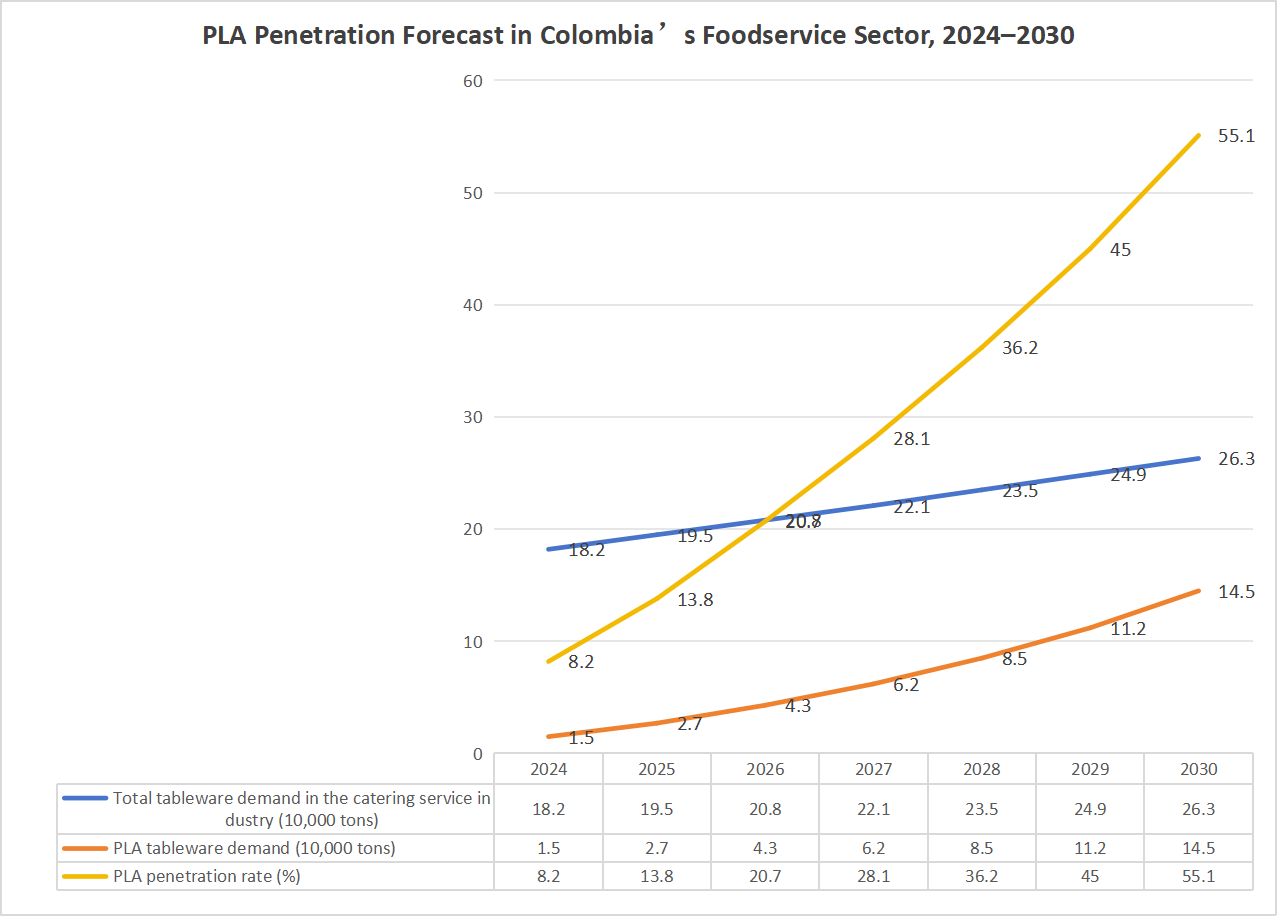

4. Colombia’s Sustainability Framework and PLA Adoption Surge

Colombia follows Chile as the second-most ambitious country in South America regarding plastic regulation.

4.1. Colombia’s Single-Use Plastics Ban (Law 2232 of 2022)

This law outlines the progressive elimination of 14 categories of single-use plastics by 2030, including:

-

Cutlery

-

Plates, cups, straws

-

EPS foam containers

-

Many non-recyclable plastic variants

PLA is identified as an environmentally preferable alternative, especially for foodservice.

4.2. Circular Economy Strategy

Colombia’s Circular Economy 2030 Plan promotes:

-

Compostable packaging

-

Biobased plastics adoption

-

Industrial composting investment

-

Green public procurement policies

PLA fits squarely within this framework because it is:

-

Resource-efficient

-

Supports new green jobs

-

Compatible with organic waste streams

4.3. Market Adoption Trends

In Colombia, PLA is increasingly used in:

-

Coffee franchises (Bogotá and Medellín)

-

Bakery chains

-

Cold drink and smoothie sectors

-

Modern supermarkets such as Éxito and Olímpica

4.4. Barriers to Full Adoption

-

Some confusion between “biodegradable,” “compostable,” and “oxodegradable”

-

Limited composting facilities outside large cities

-

Higher import duties on bioplastics compared to conventional plastics

Authority Sources Suggested

-

Ministry of Environment and Sustainable Development of Colombia

-

Colombia Circular Economy Roadmap

-

OECD Environmental Performance Review

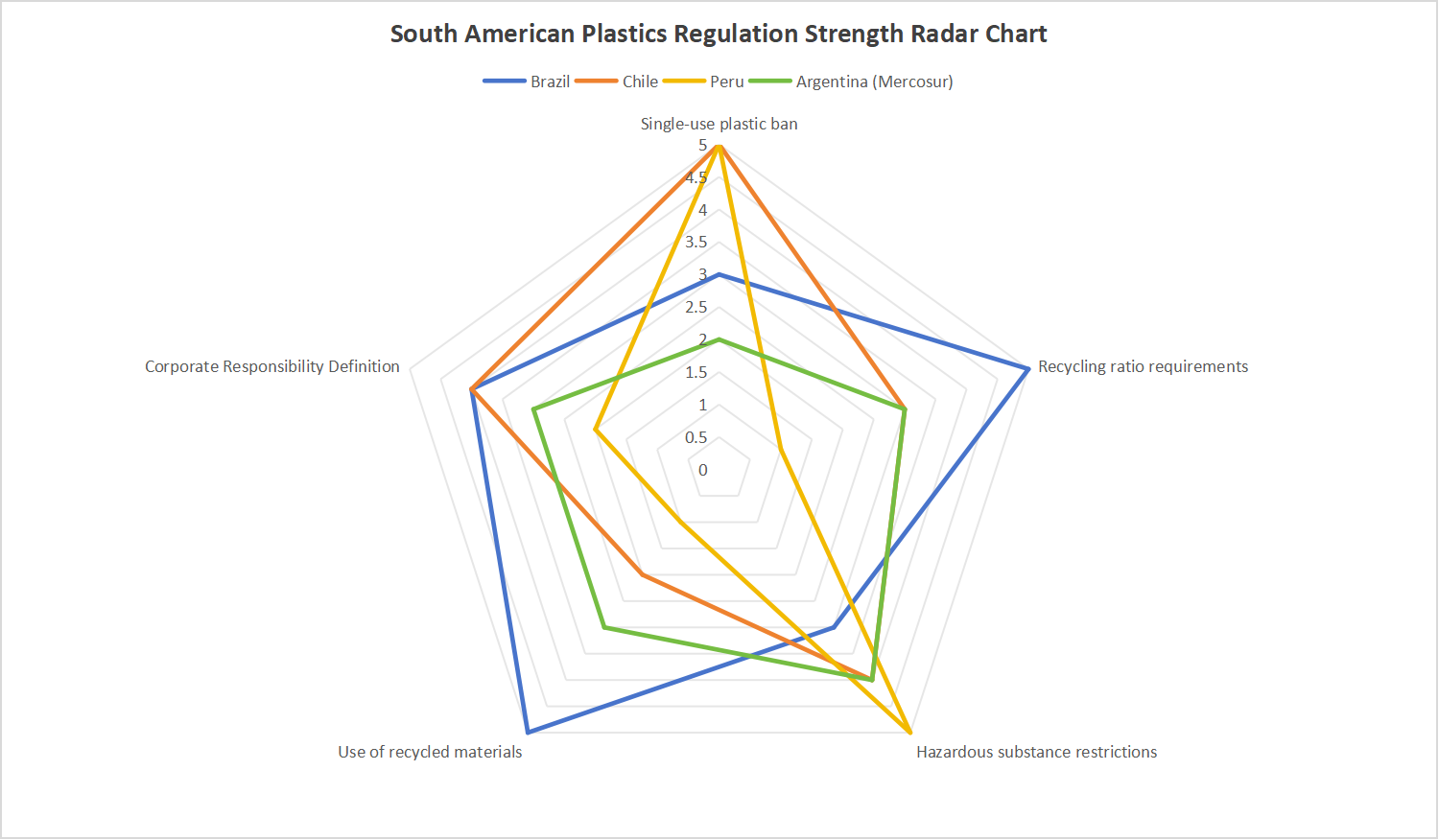

5. Comparative Analysis: Why Chile and Colombia Lead the Region

5.1. Regional Comparison Table

| Country | SUP Restrictions | Composting Infrastructure | Market for PLA |

|---|---|---|---|

| Chile | Very Strong | Moderate–Strong | High |

| Colombia | Strong | Moderate | High |

| Brazil | Moderate | Low | Limited |

| Peru | Weak–Moderate | Low | Emerging |

| Argentina | Weak | Low | Low |

5.2. Why These Policies Favor PLA

-

Bans on PS and EPS

-

Restrictions on fossil-based plastics in take-away foodservice

-

National commitments to circular economy models

6.Industry Response: How Suppliers Are Supporting Chile and Colombia’s Shift to PLA

As regulatory pressure intensifies in Chile and Colombia, global packaging manufacturers are accelerating the development of compliant, certified, and export-ready biobased solutions. One representative example is DASHAN, a leading producer of PLA and bagasse food-contact packaging with a fully certified manufacturing system and extensive international market experience.

DASHAN operates its own modern factory under ISO 9001 and ISO 14001 management systems, ensuring stable, traceable, and globally compliant production. All PLA cups are tested according to FDA (CFR 21) and EU 10/2011 food-contact standards—two certifications that are widely recognized for import compliance in South America. This gives foodservice chains, beverage brands, and retailers in Chile and Colombia assurance that their packaging aligns with national safety and regulatory requirements.

To meet regional demand for sustainable beverage packaging, DASHAN has developed a comprehensive range of crystal-clear PLA cold-drink cups (9 oz to 20 oz) with both dome and flat lids, designed for juices, iced coffee, fruit tea, and smoothies. These products are not only industrially compostable but also exempt from Colombia’s plastic tax, providing a practical compliance advantage for local businesses.

DASHAN’s international presence also strengthens its credibility. The company participates regularly in Interpack (Germany), Pack Expo (USA), Tokyo Pack (Japan), and FHA-Food & Beverage (Singapore), showcasing new sustainable packaging solutions to global buyers. With exports to over 30 countries, including the U.S., Canada, Chile, Colombia, Australia, Japan, the U.K., and the EU, DASHAN maintains a stable supply chain that supports South American distributors and brand owners seeking dependable PLA alternatives.

Through its certified production, worldwide exhibition experience, and proven export performance, DASHAN provides a reliable model of how suppliers are helping Chile and Colombia transition from fossil-based plastics toward compostable, regulation-ready packaging.

7. Opportunities for Packaging Manufacturers and Importers

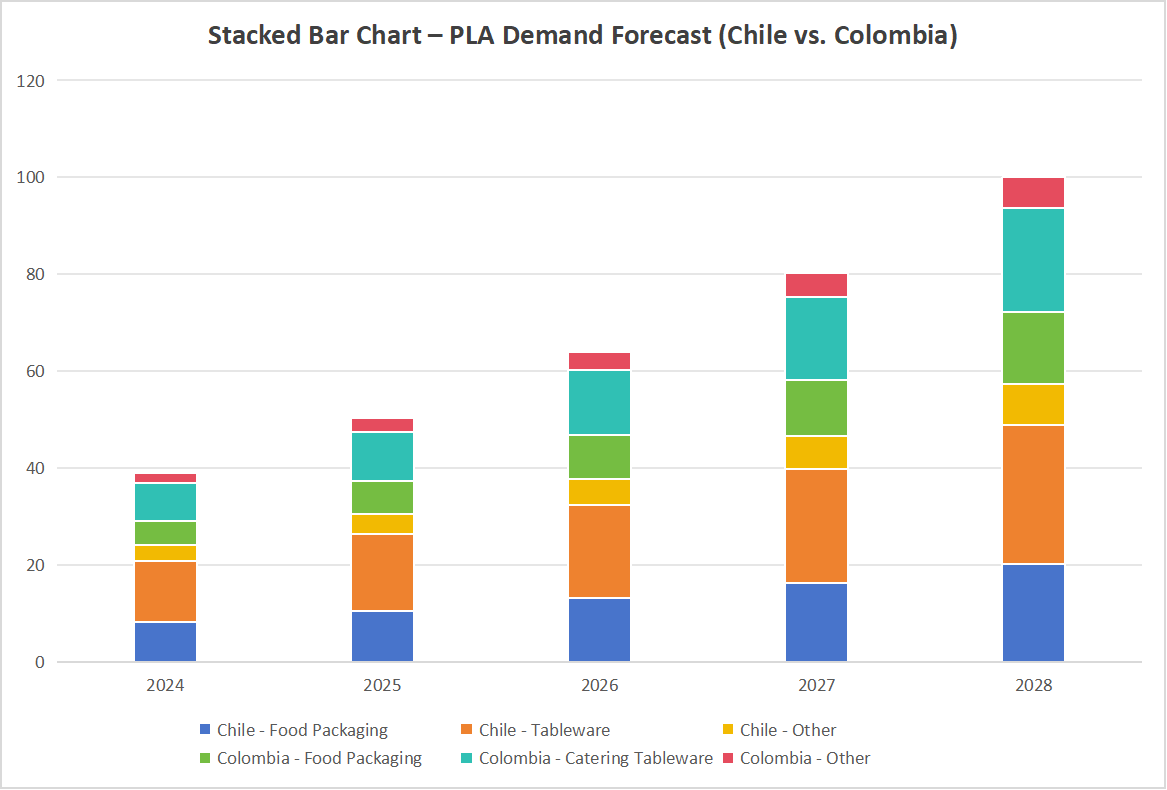

7.1. PLA Demand Forecast (2025–2030)

| Year | Chile PLA Demand (tons) | Colombia PLA Demand (tons) |

|---|---|---|

| 2025 | 4,800 | 5,200 |

| 2026 | 5,500 | 6,100 |

| 2027 | 6,300 | 7,200 |

| 2028 | 7,100 | 8,300 |

| 2029 | 8,000 | 9,500 |

| 2030 | 9,000 | 11,000 |

7.2. High-Growth Product Segments

-

PLA cold drink cups

-

Smoothie and juice cups

-

PLA lids (flat and dome)

-

PLA food containers and salad bowls

7.3. Investment Opportunities

-

Local composting facilities

-

PLA cup manufacturing lines

-

Branding and ESG integration solutions for major retailers

8. Challenges Preventing PLA from Reaching Full Potential

8.1. Composting Infrastructure Gap

PLA requires industrial composting, not home composting.

Infrastructure remains uneven across both countries.

8.2. Product Mislabeling Risks

Unscrupulous suppliers sometimes misuse terms like:

-

“biodegradable plastic”

-

“eco-plastic”

-

“oxo-degradable”

Countries like Chile have already banned oxo-degradable plastics, reinforcing the need for PLA to be correctly identified as a certified industrially compostable material.

8.3. Cost Barrier

PLA still costs 20–60% more than PET in many markets.

8.4. Limited Heat Resistance

PLA cups are suited mainly for cold beverages, not hot drinks.

9. Case Studies of Successful PLA Adoption

9.1. Coffee Chain Adoption (Chile)

A national coffee brand replaced PS and PET cold drink cups with PLA across 80+ stores.

Result:

-

Reduced annual plastic waste by 36%

-

Improved ESG rating

-

Positive consumer response

9.2. Supermarket Chain Usage (Colombia)

Major supermarket chains introduced PLA salad bowls and cups in their ready-to-eat aisles.

Outcome:

-

22% reduction in fossil-based plastic packaging

-

Enhanced corporate sustainability reporting

9.3. Local Packaging Producer Transition

Small manufacturers in Bogotá and Santiago have successfully:

-

Retrofitted thermoforming equipment

-

Adopted PLA film extrusion

-

Increased exports to nearby countries

10. Expert Insights from Global Authorities

Experts from organizations such as:

-

European Bioplastics

-

UNEP Latin America Office

-

Colombia’s Ministry of Environment

-

ASIPLA (Chilean Plastics Association)

recognize PLA as one of the most scalable biobased materials for South America’s evolving regulatory environment.

Dr. Michelle Ruiz, a sustainability researcher at UNEP LAC, notes:

“Chile and Colombia have created policy environments where bioplastics like PLA can thrive, provided the region continues investing in composting infrastructure.”

FAQ

1. Why is PLA packaging growing so fast in Chile and Colombia?

Because both countries have enacted strict plastic reduction laws, EPR requirements, and taxes on non-recyclable plastics, pushing companies to switch to compostable alternatives like PLA.

2. Is PLA considered compliant for food-contact use in these countries?

Yes. PLA is generally accepted as a food-contact material when it meets FDA or EU food safety standards. Chile and Colombia recognize these certifications for imported packaging.

3. Does PLA reduce plastic tax obligations in Colombia?

Yes. Colombia’s plastic tax applies to non-recyclable fossil-based plastics. Certified compostable PLA is exempt, giving companies a financial incentive to switch.

4. What industries are adopting PLA the fastest?

Foodservice chains, café and beverage brands, supermarket deli areas, airline catering, and large event venues are leading adopters due to high visibility and regulatory pressure.

5. What challenges still limit PLA adoption in South America?

Limited composting infrastructure, higher unit costs, supply availability, and the need for clearer labeling standards remain key operational challenges.

Conclusion: The Future of PLA in Chile and Colombia

PLA’s rise in Chile and Colombia is not temporary—it is a structural shift fueled by regulatory, economic, and social factors. Both countries have laid out clear pathways to reduce fossil-based plastics, creating strong demand for compostable alternatives, especially in foodservice and beverage packaging.

While challenges remain, particularly in composting infrastructure and cost management, the long-term direction is unmistakable:

PLA will become one of the most widely adopted sustainable materials in South America’s packaging industry.

For manufacturers, importers, and global packaging brands, now is the time to invest in PLA capacity, supply chains, and market development in both countries.

References

-

Chile – Single-Use Plastics Law (Ley 21.368)

https://www.bcn.cl/leychile/navegar?idNorma=1173032 -

Chile Ministry of Environment – EPR (Ley REP) Guidelines

https://mma.gob.cl/ley-rep/ -

Colombia Plastic Tax (Impuesto Nacional al Consumo de Plásticos) — DIAN Official Tax Portal

https://www.dian.gov.co/ -

Colombia Circular Economy Strategy 2030

https://www.minambiente.gov.co/ -

Ellen MacArthur Foundation – Global Plastics Policy Overview

https://ellenmacarthurfoundation.org/

Copyright Statement

© 2025 Dashan Packing. All rights reserved.

This article is an original work created by the Dashan Packing editorial team.

All text, data, and images are the result of our independent research, industry experience,

and product development insights. Reproduction or redistribution of any part of this content

without written permission is strictly prohibited.

Dashan Packing is committed to providing accurate, evidence-based information and

to upholding transparency, originality, and compliance with global intellectual property standards.