Quick Summary

Plastic bans in Asia are often described in extreme terms, leading many food packaging buyers to believe that plastic is being rapidly eliminated across the region. In reality, most Asian governments are applying selective, phased plastic reduction strategies rather than blanket bans. Misunderstanding these policies frequently causes buyers to overreact—switching materials prematurely, increasing costs, and even creating new compliance and performance risks. This article breaks down five of the most common myths about plastic bans in Asia and explains what experienced buyers focus on instead.

Introduction: Why Plastic Ban Myths Spread So Easily in Asia

Asia is often portrayed as the center of the global plastic pollution problem. Media reports frequently cite statistics about ocean plastic leakage and showcase dramatic government announcements promising plastic-free futures. While these narratives capture attention, they rarely reflect how plastic regulations are actually written, implemented, or enforced.

One reason myths spread so easily is that plastic bans are rarely explained in technical or commercial terms. Headlines tend to simplify complex regulatory frameworks into absolute statements: “Plastic is banned,” “Single-use plastics outlawed,” or “Businesses must switch to compostable packaging.” For procurement teams, especially those sourcing packaging across multiple Asian countries, these messages create anxiety and pressure to act quickly.

Another factor is that Asia is not a single regulatory market. Each country—and often each city—faces different infrastructure constraints, economic priorities, and food safety considerations. Applying a one-size-fits-all interpretation inevitably leads to incorrect conclusions.

For food packaging buyers, separating perception from reality is not just an academic exercise. It directly affects cost structures, supply stability, and long-term compliance strategy.

Myth 1: Plastic Is Completely Banned Across Asia

What People Think

A common assumption is that Asian governments are moving toward a complete elimination of plastic packaging, leaving businesses no choice but to abandon plastic entirely.

The Reality

There is no Asia-wide ban on plastic. Instead, most countries adopt targeted restrictions aimed at reducing the most problematic and visible plastic waste streams. These policies focus on items that are:

-

Used briefly

-

Disposed of improperly

-

Difficult or uneconomical to recycle

Examples include ultra-thin shopping bags, plastic straws, and disposable stirrers.

By contrast, rigid food-grade plastic packaging performs essential functions related to hygiene, shelf life, transport efficiency, and food safety. Eliminating these products without proven alternatives would create significant risks.

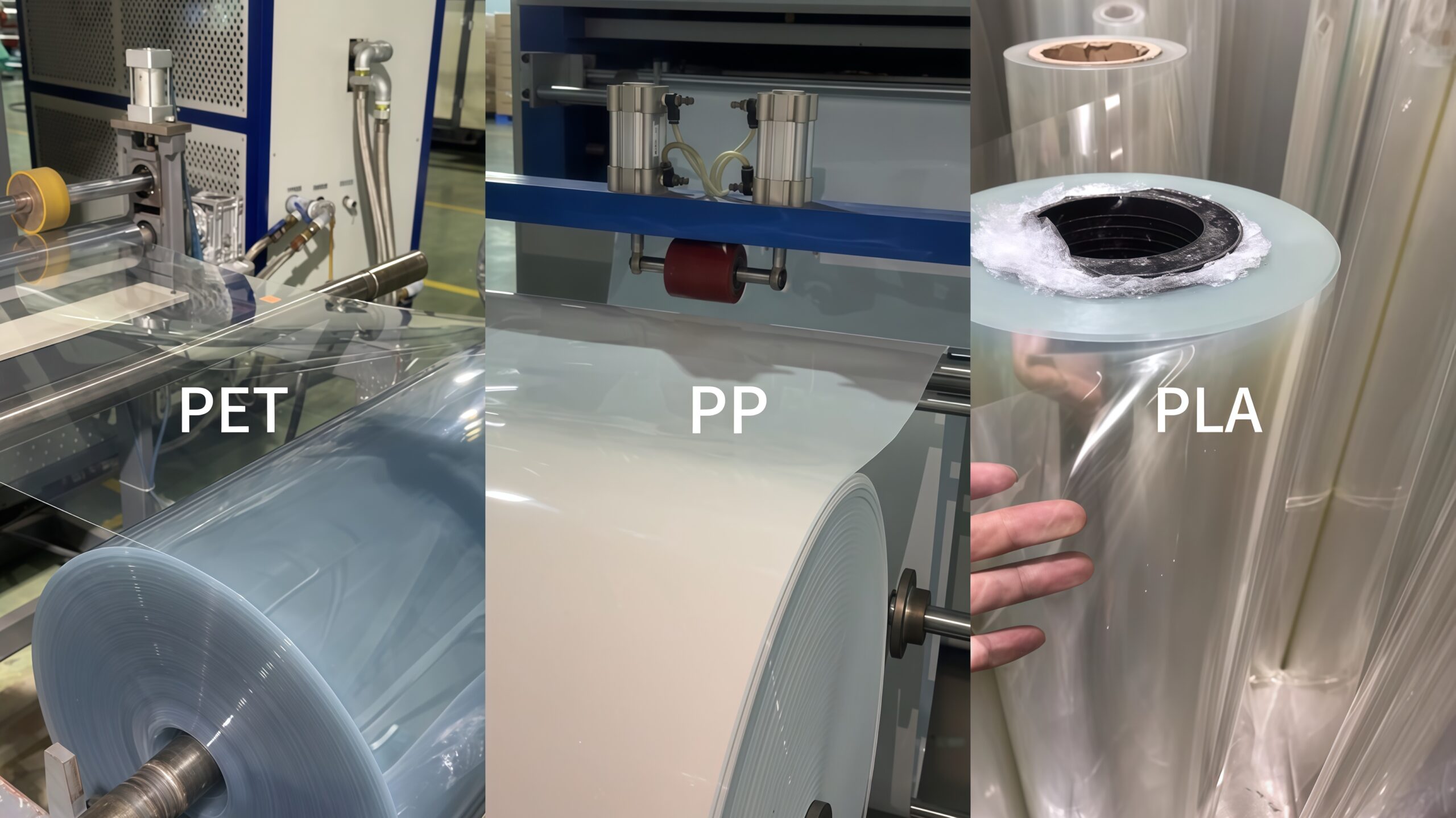

As a result, food containers, trays, and cups made from materials such as PET and PP remain legal and widely used across Asian markets.

Buyer Takeaway

Buyers should avoid treating “plastic” as a single category. Regulations almost always distinguish between problematic disposable items and functional food packaging.

Myth 2: Food Packaging Is the Primary Target of Plastic Bans

What People Think

Because food packaging is highly visible, many buyers believe it is the main focus of plastic bans.

The Reality

In practice, food packaging is often one of the last categories governments restrict. There are several reasons for this:

-

Food Safety

Plastic packaging provides reliable barriers against contamination, moisture, and temperature fluctuations. -

Economic Impact

Millions of small food vendors across Asia rely on affordable, lightweight packaging to operate profitably. -

Infrastructure Limitations

Many alternative materials lack stable supply chains or disposal systems at scale.

Instead of banning food packaging, regulators typically apply softer measures, such as encouraging recyclability, reducing material thickness, or limiting unnecessary accessories like lids or secondary packaging.

Buyer Takeaway

Food packaging usually faces regulatory guidance, not prohibition. Buyers should assess actual policy language rather than assume worst-case scenarios.

Myth 3: Compostable Packaging Is Always the Best Compliance Choice

What People Think

Many buyers assume compostable or biodegradable packaging is required—or at least strongly preferred—under Asian plastic regulations.

The Reality

Compostable packaging only delivers environmental benefits when supported by appropriate infrastructure. In much of Asia, industrial composting systems are limited, fragmented, or absent altogether. In these conditions, compostable products are often disposed of alongside conventional waste.

Additionally, compostable materials can introduce operational challenges:

-

Reduced heat resistance

-

Limited performance with oily or acidic foods

-

Shorter shelf life

-

Higher and more volatile costs

Because of these issues, regulators increasingly recognize that recyclable plastics may offer more immediate environmental benefits than poorly managed compostables.

Buyer Takeaway

Material choice should reflect local waste management reality, not marketing labels. In many Asian markets, recyclable plastics align better with policy objectives.

Myth 4: Plastic Bans Are Enforced Uniformly Across Asia

What People Think

Another common belief is that once a regulation is announced, it is enforced consistently across all regions.

The Reality

Enforcement varies dramatically:

-

Some countries rely heavily on voluntary compliance

-

Others delegate enforcement to local governments

-

Urban areas often enforce rules more strictly than rural ones

For example, a packaging format accepted in one city may face scrutiny in another—even within the same country. This variability is one of the biggest sources of confusion for importers and multinational brands.

Buyer Takeaway

Regulatory risk in Asia often comes from interpretation and enforcement differences, not from the written law itself. Flexibility is essential.

Myth 5: Immediate Material Switching Reduces Risk

What People Think

Under regulatory pressure, many buyers believe the safest option is to immediately replace plastic packaging with alternative materials.

The Reality

Rapid material switching can create new risks:

-

Increased unit costs and pricing instability

-

Supply chain disruptions

-

Performance failures in real food service conditions

In some cases, alternative materials may face future regulatory scrutiny or lack clear end-of-life pathways.

Experienced buyers often adopt a staged approach—optimizing existing plastic packaging first, then testing alternatives in controlled contexts.

Buyer Takeaway

Compliance is a process, not a one-time material decision.

How Experienced Buyers Navigate Plastic Bans in Practice

Across Asian markets, seasoned food packaging buyers focus on risk management rather than symbolism. Their strategies typically include:

-

Reducing material weight before switching materials

-

Favoring mono-material designs compatible with recycling

-

Maintaining multiple approved packaging options

From DASHAN’s experience working with buyers across Southeast Asia, this incremental approach consistently proves more resilient. Instead of reacting to headlines, buyers who track regulatory direction and infrastructure readiness adapt more smoothly and avoid unnecessary costs.

A Deeper Look: Why Governments Still Rely on Plastic Packaging

Despite growing environmental pressure, plastic remains deeply embedded in Asia’s food systems. Its advantages—lightweight, durability, hygiene, and cost efficiency—are difficult to replicate at scale.

Governments are therefore cautious. Rather than banning plastic outright, they focus on:

-

Reducing waste leakage

-

Improving collection systems

-

Encouraging recyclable formats

This reality explains why plastic reduction policies often coexist with continued plastic usage.

What Buyers Should Do Instead: A Practical Decision Framework

Instead of reacting to myths, buyers should ask:

-

Is this packaging category explicitly restricted?

-

How is the regulation enforced locally?

-

What disposal infrastructure exists?

-

Does the alternative perform equally in food safety and logistics?

This framework leads to more stable, defensible decisions.

Recap: Myth vs Reality

| Myth | Reality |

|---|---|

| Plastic is banned everywhere | Bans are selective |

| Food packaging is targeted first | It is often protected |

| Compostable is always required | Infrastructure matters |

| Rules are uniform | Enforcement varies |

| Fast switching reduces risk | Incremental change works better |

FAQ

1. Are plastics completely banned in Asia?

No. Most Asian countries apply selective restrictions on specific single-use items rather than banning all plastic packaging, especially food-grade plastics.

2. Is food packaging a main target of plastic bans?

Generally no. Food packaging is usually regulated cautiously due to food safety, hygiene, and supply chain considerations.

3. Do Asian regulations require compostable packaging?

In most cases, no. Many governments prioritize recyclability over compostability due to limited composting infrastructure.

4. Are plastic bans enforced the same way across Asia?

Enforcement varies widely by country, city, and even district. Local implementation often matters more than national announcements.

5. Is switching materials immediately the safest compliance strategy?

Not necessarily. Rapid switching can increase costs and introduce performance risks without improving regulatory compliance.

6. Are PET and PP still acceptable for food packaging in Asia?

Yes. PET and PP remain widely used and accepted due to their recyclability, safety, and established waste management pathways.

7. How should buyers prepare for future plastic regulations?

Buyers should focus on material reduction, recyclable mono-material designs, and flexible sourcing strategies rather than reacting to headlines.

Conclusion: Clarity Is the Real Competitive Advantage

Plastic bans in Asia are complex, evolving, and frequently misunderstood. Buyers who rely on headlines often overcorrect—raising costs and creating new risks without improving compliance. Those who invest in understanding regulatory nuance, infrastructure reality, and material performance gain a lasting advantage. In Asia’s packaging landscape, clarity consistently outperforms panic.

✅ References

-

United Nations Environment Programme (UNEP)

https://www.unep.org/resources/report/single-use-plastics-roadmap-sustainability -

World Bank – Market-Based Instruments for Plastic Waste

https://www.worldbank.org/en/topic/environment/brief/market-based-instruments-for-plastic-waste -

OECD – Global Plastics Outlook

https://www.oecd.org/environment/plastics/global-plastics-outlook/ -

European Commission – Plastic Strategy (Global Reference)

https://environment.ec.europa.eu/strategy/plastics-strategy_en -

Asia Development Bank (ADB) – Managing Plastic Waste in Asia

https://www.adb.org/publications/managing-plastic-waste-asia -

Ellen MacArthur Foundation – Global Commitment

https://ellenmacarthurfoundation.org/global-commitment

Copyright Statement

© 2026 Dashan Packing. All rights reserved.

This article is an original work created by the Dashan Packing editorial team.

All text, data, and images are the result of our independent research, industry experience,

and product development insights. Reproduction or redistribution of any part of this content

without written permission is strictly prohibited.

Dashan Packing is committed to providing accurate, evidence-based information and

to upholding transparency, originality, and compliance with global intellectual property standards.