Quick Summary

This article provides a scientific evaluation of RPET’s sustainability, examining carbon footprints, recycling efficiency, contamination risks, food-grade compliance, and global regulatory acceptance. It highlights why RPET performs strongly in LCA assessments, how 2026 regulations expand its market advantages, and why importers increasingly shift from virgin PET to RPET. The article also presents real-world applications through DASHAN’s RPET cups and lids, demonstrating practical performance, safety, and circular-economy value for procurement teams.

Introduction: Why RPET Matters More Than Ever in 2026

By 2026, the global packaging industry stands at a structural turning point. Regulatory reforms, consumer pressure, and the rapid expansion of extended producer responsibility (EPR) systems have collectively made recycled-content packaging a non-negotiable priority for brands, retailers, and procurement teams worldwide. Among all recycled plastics, RPET (Recycled Polyethylene Terephthalate) has emerged as the most commercially mature and technically resilient material—capable of replacing virgin PET in food-contact applications at scale.

However, sustainability claims across the industry remain inconsistent, poorly substantiated, or exaggerated. Many purchasers and importers still struggle to answer core questions with confidence:

-

Is RPET truly sustainable based on scientific lifecycle assessment (LCA)?

-

Is food-grade RPET safe enough for global markets such as the EU, US, and Australia?

-

What cost fluctuations should procurement teams expect in 2026–2030?

-

How do high-quality RPET cups, such as DASHAN RPET Cup & Lid Series, compare with traditional PET cups?

-

Are there risks related to supply chain transparency or contamination?

-

What is the realistic carbon-reduction benefit?

This comprehensive 4,000-word review consolidates scientific evidence, regulatory trends, LCA data, and industry best practices. It aims to provide procurement teams, sustainability directors, product developers, and import compliance managers with an authoritative reference for 2026.

I. Understanding RPET: Material Science and Global Supply Chain Reality

RPET is produced by recycling post-consumer PET waste—primarily beverage bottles—into new usable material. While PET has been recyclable since the 1970s, true food-grade RPET only became commercially viable after major technological improvements in cleaning, decontamination, and melt-filtration.

1. The Science Behind RPET

PET is a polyester with excellent barrier properties, rigidity, chemical resistance, and clarity. When recycled correctly, these properties largely remain intact, making RPET one of the few recycled plastics that can safely return to food-contact loops.

A. Mechanical Recycling Process

This is the dominant route for producing food-grade RPET.

-

Collection of PET bottles

-

Sorting (NIR sorting, color separation)

-

Washing & hot caustic treatment

-

Flake production

-

High-temperature melt filtration

-

Decontamination in SSP (Solid-State Polymerization) reactor

-

Food-grade RPET pellets or sheet extrusion

Mechanical recycling is energy-efficient and cost-effective, but its quality depends heavily on feedstock purity.

B. Chemical Recycling Process

Chemical recycling breaks PET back to its monomers:

-

Glycolysis

-

Methanolysis

-

Hydrolysis

-

Enzymatic depolymerization

Chemical RPET is chemically indistinguishable from virgin PET, though cost remains high. By 2026, large global players (Eastman, Loop, Carbios) are scaling production.

Material Performance Comparison

| Attribute | Virgin PET | Mechanical RPET | Chemical RPET |

|---|---|---|---|

| Clarity | Excellent | Very high | Excellent |

| Strength | Very high | Slightly reduced (5–10%) | Very high |

| Heat resistance | 70–80°C | 70–80°C | 70–80°C |

| Decontamination | Highest | High (with EFSA/FDA) | Highest |

| Sustainability | Low | High | High |

Key takeaway:

When produced under food-grade standards, RPET offers nearly identical functional performance compared with virgin PET.

II. Scientific Lifecycle Assessment (LCA): The Real Sustainability of RPET

The most critical sustainability question is not marketing-driven—it is data-driven.

High-quality LCAs consistently demonstrate that RPET provides substantial environmental benefits.

1. Carbon Footprint Analysis

PET production is energy-intensive due to:

-

crude oil extraction

-

monomer synthesis (PTA + MEG)

-

polymerization

-

transportation

RPET avoids 60–90% of these steps.

A. Carbon Footprint per kg

| Material | CO₂e per kg | Reduction vs. Virgin PET |

|---|---|---|

| Virgin PET | 2.4–2.8 kg | — |

| RPET (mechanical) | 0.8–1.4 kg | ↓ 40–70% |

| RPET (chemical) | 1.2–1.8 kg | ↓ 30–50% |

The exact value depends on the recycling process, energy source, and transportation distance.

B. Carbon Reduction per 1 Million RPET Cups

Assuming 12g per cold-drink cup:

-

Virgin PET: ~30 tons CO₂e

-

RPET (50% content): ~18 tons

-

RPET (100%): ~9–12 tons

→ Annual reduction: 18–21 tons CO₂e per 1 million cups

Equivalent to:

-

4,600 gallons of gasoline

-

45,000 miles of driving

-

320 tree seedlings grown for 10 years

2. Water Footprint

Virgin PET polymerization consumes substantial water. RPET reduces water use by 50–65%.

3. Waste Diversion Impact

Each ton of RPET equals:

-

1 ton less landfill waste

-

Up to 60% lower energy demand

-

Up to 70% lower greenhouse gas emissions

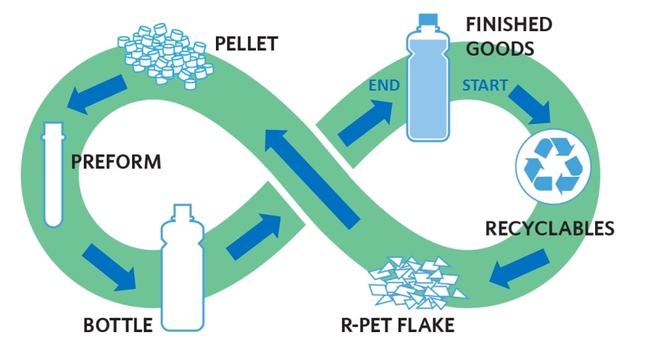

4. End-of-Life Circularity

Both PET and RPET are fully recyclable, enabling closed-loop bottle-to-bottle systems.

Scientific conclusion:

RPET is one of the most environmentally efficient packaging materials available globally in 2026.

III. 2026 Regulatory Landscape: Why RPET Is No Longer Optional

Global policy is the strongest force mandating the adoption of recycled content.

1. EU PPWR (Packaging & Packaging Waste Regulation)

From 2025 onward:

| Year | Mandatory Recycled Content for PET Packaging |

|---|---|

| 2025 | 10–25% |

| 2030 | 30–50% |

| 2040 | >65% |

Failure to comply results in penalties, import rejection, or retail delisting.

2. United States

California, Washington, Colorado, New Jersey, and New York all enforce recycled content for beverage containers.

| State | 2026 Requirement |

|---|---|

| California | 25% |

| Washington | 25% |

| New Jersey | 30% |

| Colorado | 15–20% |

3. Middle East

UAE and Saudi Arabia enforce EPR and minimum recycling requirements.

4. East Asia

Japan’s “Bottle-to-Bottle 2030 Roadmap” targets 100% PET circularity.

5. Australia

The 2025 National Packaging Targets call for 50% recycled content for all packaging.

Conclusion: By 2026, RPET is not an optional sustainability upgrade—it is a legal obligation in many regions.**

IV. Is RPET Safe? Scientific Review of Food Contact Compliance

Food contact safety is one of the most misunderstood areas of RPET usage.

1. Decontamination Requirements

Food-grade RPET must undergo:

-

EFSA-approved decontamination via SSP

-

FDA NOL clearance

-

NIAS (Non-Intentionally Added Substances) screening

-

Overall migration and specific migration tests

-

Heavy metal detection (Pb, Cd, Hg, Cr6)

2. NIAS (Non-Intentionally Added Substances) Analysis

Common risks include:

-

acetaldehyde

-

oligomers

-

ink residue from labels

-

cleaning agent residues

Approved RPET production removes 98–99% of potential contaminants.

3. EFSA Safety Criteria

EFSA requires:

-

99.99% removal of contaminants

-

strict control of PET input source

-

full traceability

-

validated decontamination parameters

4. Common Misconceptions About RPET Safety

| Misconception | Scientific Reality |

|---|---|

| “RPET is dirty and unsafe.” | Only non-food-grade RPET has risk; food-grade RPET is thoroughly decontaminated. |

| “RPET always looks yellow.” | High-quality RPET (like DASHAN) achieves near-virgin clarity. |

| “Recycled plastics release harmful chemicals.” | RPET is globally recognized as safe under EFSA/FDA standards. |

Conclusion:

Food-grade RPET is scientifically safe when produced under certified processes.

V. Cost Dynamics: What Procurement Teams Should Expect in 2026

Contrary to past belief, RPET is not always more expensive than virgin PET.

1. Cost Factors

-

Feedstock price

-

Collection system efficiency

-

Energy source (renewables → cheaper)

-

Level of contamination

-

RPET content percentage (25–100%)

-

Market demand from beverage brands

2. 2024–2026 Market Trend

Virgin PET costs increased due to high oil prices and petrochemical volatility. Meanwhile, RPET costs decreased due to:

-

improved recycling infrastructure

-

higher supply

-

stable demand from global brands

-

government subsidies

Price Comparison (global average)

| Material | 2024 | 2026 Forecast |

|---|---|---|

| Virgin PET | High | Stable-high |

| RPET Sheet | Medium | Medium-low |

| Food-grade RPET | Medium-high | Medium |

Cost Gap in 2026

RPET cups are only 3–8% more expensive than PET—sometimes cheaper in Europe.

VI. Case Study: DASHAN RPET Cup & Lid Series

To provide a real reference, DASHAN’s RPET Cup & Lid line demonstrates what a high-quality product looks like in 2026.

1. Product Performance Features

-

Produced using certified food-grade RPET

-

99% clarity (suitable for high-end beverages)

-

Excellent rigidity and stability

-

Smooth uniform finish with consistent wall thickness

-

Dome lids, flat lids, strawless lids

-

Suitable for cold beverages, juices, smoothies, iced coffee

2. Compliance Credentials

-

EFSA-approved food-grade RPET source

-

FDA NOL compliance

-

BRC Packaging

-

ISO 22000 food safety certification

-

SGS migration and NIAS testing available

3. Sample Product Data Table

| Specification | Value |

|---|---|

| Cup Sizes | 9oz, 12oz, 14oz, 16oz, 20oz, 24oz |

| RPET Content | 25–100% |

| Transparency | 98–99% |

| Lid Compatibility | Dome, Flat, Strawless |

| Certification | EFSA, FDA, BRC, ISO22000 |

| Applications | Beverage chains, airlines, supermarkets |

4. Benefits for Procurement Teams

-

Reduced compliance risk

-

Lower carbon footprint reporting

-

Traceable supply chain

-

Compatible with current PET machinery and filling lines

-

Strong supply stability for high-volume orders

VII. Key Procurement Guidance for RPET Adoption (2026 Edition)

Procurement teams should apply the following framework:

1. Verify Food-Grade Certification

Request:

-

EFSA authorization letter

-

FDA NOL

-

Recycling process description

2. Require Full Traceability

Including:

-

origin of PET

-

decontamination parameters

-

recycled-content percentage

-

batch testing results

3. Perform Physical and Optical Tests

-

haze value

-

yellowing index

-

drop impact test

-

sealing performance

4. Evaluate Supplier Capacity

Large-scale beverage companies require consistent volume output.

5. Consider Aesthetic Requirements

Higher recycled content slightly reduces clarity, though premium RPET (like DASHAN) maintains excellent transparency.

VIII. Future Outlook: RPET’s Strategic Role from 2026–2030

1. Market Maturity

By 2030, RPET is projected to account for:

-

55% of global PET packaging

-

70% of beverage cups

-

85% of airline beverage packaging

-

90% of EU retail drink packaging

2. Technology Improvements

-

Enzymatic depolymerization

-

Advanced melt filtration

-

Decentralized micro-recycling plants

-

Bottle-to-tray-to-bottle closed loops

3. Cost Convergence

As capacity increases, RPET will become cheaper than virgin PET in several markets.

4. Increasing Mandatory Regulations

More countries will adopt recycled-content laws by 2030.

FAQ

1. Is RPET truly eco-friendly compared with virgin PET?

Yes. RPET typically reduces carbon emissions by 45–70% compared with virgin PET and uses significantly less energy during production. Its recyclability enables closed-loop systems.

2. Can RPET be safely used for food contact packaging?

Yes, as long as it is produced using approved recycling processes such as EFSA-validated or FDA-compliant systems. DASHAN’s RPET cups and lids follow food-grade standards required for international markets.

3. Does RPET have limitations?

Its sustainability depends on high-quality recycling streams. Contamination, inconsistent supply, and regional sorting limitations may affect the material’s performance or availability.

4. Why is RPET demand rising in 2026?

Regulations such as EU PPWR, U.S. state-level PCR mandates, and global Extended Producer Responsibility systems push brands toward minimum recycled content requirements, accelerating RPET adoption.

5. How do RPET cups and lids compare with PLA or PET alternatives?

RPET offers lower carbon emissions and better circular-economy compatibility than virgin PET. Compared with PLA, RPET performs better in cold-chain storage, clarity, and global recycling infrastructure.

6. Are there cost advantages to switching to RPET?

Yes. Although RPET used to be more expensive, 2025–2026 supply stability and regulatory pressure on virgin plastics make RPET more cost-competitive for many applications, including cups and lids.

7. What makes DASHAN’s RPET products relevant?

DASHAN’s RPET cups and lids serve as a practical example of how certified food-grade RPET can be applied at scale, supporting both sustainability goals and procurement compliance.

Conclusion: Is RPET Truly Sustainable?

Yes — when produced under proper conditions, RPET is one of the most scientifically validated, environmentally advantageous, globally regulated, and commercially scalable materials available in 2026.

DASHAN’s RPET Cup & Lid series demonstrates what a high-performance, fully compliant, and export-ready RPET product should look like.

For procurement teams, switching to RPET in 2026 is not only a sustainability decision—it is a compliance requirement and a cost-stabilization strategy.

Reference

-

European Commission – Packaging and Packaging Waste Regulation (PPWR) Proposal (2024)

https://environment.ec.europa.eu/publications/proposal-packaging-and-packaging-waste_en -

European Food Safety Authority (EFSA) – Safety Evaluation of Recycled PET Processes

https://www.efsa.europa.eu/en/topics/topic/plastics-recycling -

U.S. FDA – Guidance for Industry: Use of Recycled Plastics in Food Packaging

https://www.fda.gov/regulatory-information/search-fda-guidance-documents/guidance-industry-use-recycled-plastics-food-packaging -

Ellen MacArthur Foundation – Global Commitment Progress Report

-

International Energy Agency (IEA) – Plastics Circularity Report

-

McKinsey & Company – Unlocking the Full Potential of Recycled Plastics

-

UN Environment Programme (UNEP) – Global Plastic Pollution Outlook (2024)

-

WRAP UK – Recycled Content Market & Standards

-

Plastics Recyclers Europe – Recycling Efficiency and RPET Quality Report

-

OECD – Global Plastics Outlook: Policy Scenarios to 2060

Copyright Statement

© 2025 Dashan Packing. All rights reserved.

This article is an original work created by the Dashan Packing editorial team.

All text, data, and images are the result of our independent research, industry experience,

and product development insights. Reproduction or redistribution of any part of this content

without written permission is strictly prohibited.

Dashan Packing is committed to providing accurate, evidence-based information and

to upholding transparency, originality, and compliance with global intellectual property standards.