1. Executive Summary — Biodegradable Food Packaging 2025

In 2025, biodegradable and compostable food packaging has evolved from a green marketing strategy to a compliance-driven requirement. Analysts project that the compostable and sustainable packaging market will experience a compound annual growth rate (CAGR) of approximately 6-7% through 2030. This growth is largely driven by increasingly stringent regulatory frameworks and Extended Producer Responsibility (EPR) programs, which now serve as primary catalysts for demand rather than merely optional sustainability preferences. As global regulations tighten, businesses are facing a new era where adopting certified sustainable packaging solutions is not just a choice, but an obligation to remain competitive and compliant.

1.1 Evidence-Backed Conclusions

1) Market | Structural Growth Driven by Regulation Rather Than Preference

Foodservice and retail buyers are increasingly prioritizing compliance-driven packaging over unit price alone. This shift is evident as companies focus more on auditable compliance packages (such as certifications for compostability, accurate labeling, PFAS-free materials, and EPR readiness). Market outlooks predict durable growth (approximately 6-7% CAGR to 2030), with procurement decisions moving away from price-based criteria to risk-adjusted Total Cost of Ownership (TCO) and regulatory compliance certainty.

2) Compliance | Regulatory Shifts Across the EU and U.S.

The European Union’s Packaging & Packaging Waste Regulation (PPWR), effective February 2025, will require significant improvements in recyclability, reuse, labeling, and recycled content. This regulation is expected to reshape the market by superseding prior directives and introducing stronger requirements. In the U.S., recent regulations, such as California’s SB 54 and the FDA’s phase-out of PFAS-containing grease-proofing agents for food-contact materials (2024), mandate that packaging be either recyclable or compostable. These changes are pushing manufacturers toward compliance with environmental standards, ensuring that the shift to sustainable materials becomes the baseline rather than an exception.

3) TCO | End-of-Life Considerations and Policy Signals Determine Winners

In the U.S., more than 14.9 million households have access to residential food-waste collection, yet only about 5% of food waste is composted. This geographic disparity in composting access significantly affects the TCO of compostable packaging. According to the EPA, nearly 71% of full-scale food-waste composting facilities report accepting some compostable food-contact packaging, though conditions vary by region. As such, TCO modeling must be done on a city-by-city basis, factoring in local infrastructure capabilities, unit price, logistics, EPR costs, and end-of-life fees. Understanding these regional variations will help businesses make better decisions regarding their packaging strategies.

1.2 Actionable Recommendations

Short Term (0–6 months) — Secure the “License to Sell”

-

Publish clear evidence of PFAS-free status through third-party tests and supplier attestations.

-

Ensure all packaging materials, such as PLA and bagasse, meet the latest EU PPWR regulations (prevention, recyclability, reuse, labeling).

-

Implement a standardized compliance annex for every bid, featuring certifications such as EN 13432, ASTM D6400, and TÜV.

Mid-term (6–18 months) — Rebuild Portfolio Around Scenario-Fit TCO

-

Align packaging products by use case (e.g., PLA for cold drinks and salads, bagasse for hot and oily foods).

-

Assess city-level composting infrastructure to tailor strategies for compostable vs recyclable packaging, integrating local EPR/carbon/end-of-life costs into a live TCO model.

-

Explore urban organics pilots in regions with high composting access, leveraging the benefits of compostable packaging to reduce long-term costs.

Long Term (18–36 months) — Turn Compliance into a Moat

-

Develop batch-level traceability and change control systems to ensure full compliance during customer and customs audits.

-

Design products to meet PPWR timelines for recyclability and readiness for reuse, minimizing retrofit risks and ensuring compliance with evolving regulations.

-

Invest in growing partnerships with composters and municipalities to expand organics collection infrastructure, ensuring long-term sustainability.

1.3 Key Figures (for the Executive Deck)

-

Figure 1 — 2025 Global Regulatory Heatmap

This figure illustrates the status of regulations for compostable and recyclable packaging in key global regions, highlighting the progress of compliance in markets such as the EU, U.S., and California. These regions are leading the way in adopting and enforcing stricter packaging regulations.

-

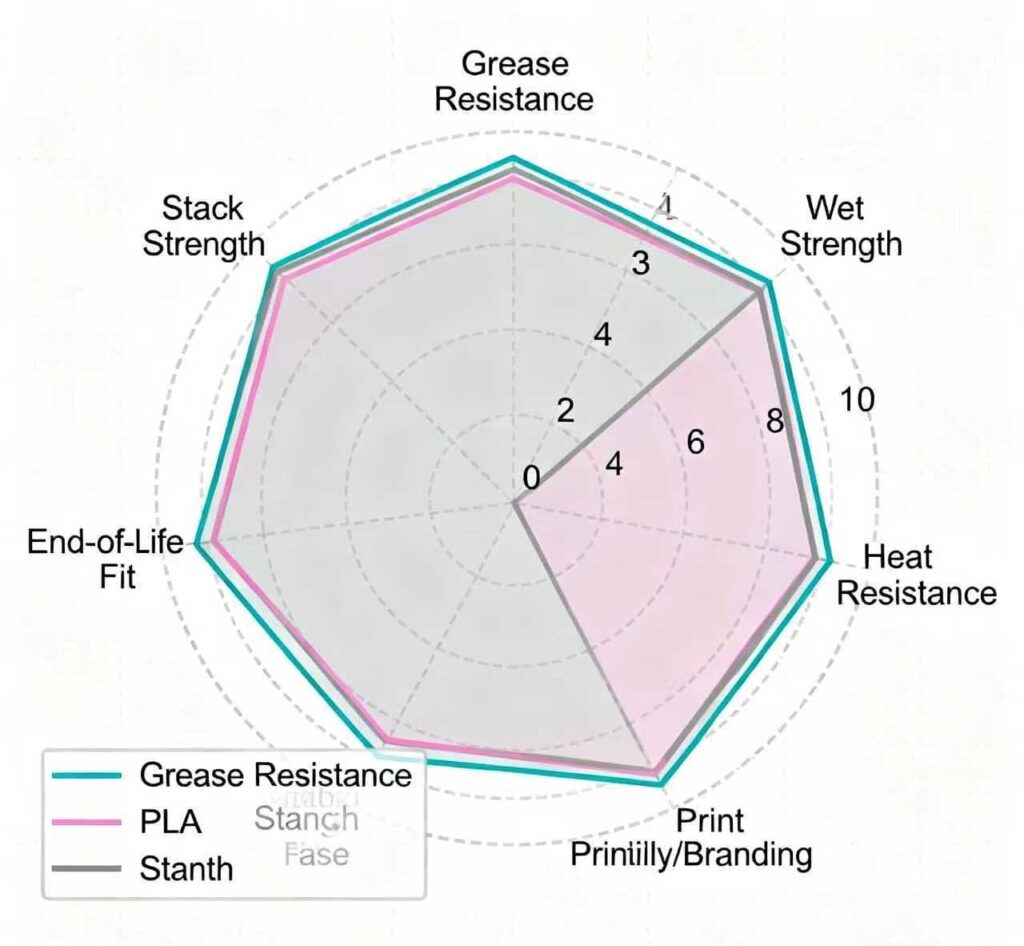

Figure 2 — Material Performance Radar

This radar compares the functional performance of common compostable packaging materials such as bagasse and PLA against alternatives. The chart evaluates key properties, including heat resistance, wet strength, grease resistance, and end-of-life fit, providing insight into which materials best meet specific foodservice needs.

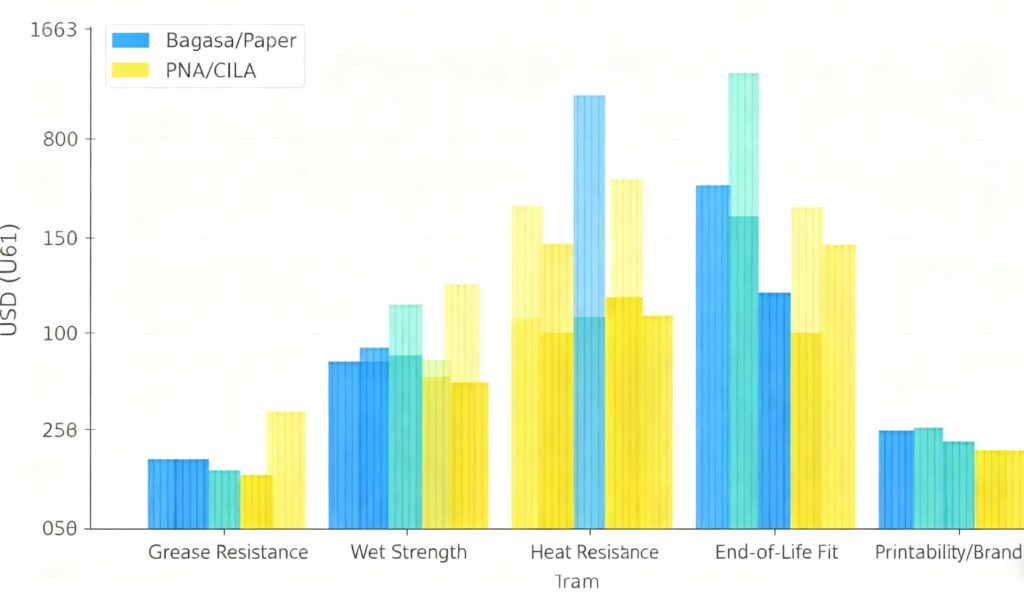

- Figure 3 — TCO Waterfall

This figure highlights how compostable packaging performs in different regions based on composting access and EPR coverage. It shows where compostables win in high-access composting regions, and where recyclable packaging solutions may be more appropriate in areas with less composting infrastructure.

2. Methodology

2.1 Sample Design

Target Population.

The target population of this study includes key decision-makers and influencers involved in food packaging procurement, compliance, and operations across various sectors:

-

Quick-Service Restaurants (QSR) / Fast Food

-

Supermarkets / Retail

-

Catering Services / Restaurants

-

Food Delivery Platforms

-

Airline Catering

-

Healthcare / Education

These individuals are typically responsible for overseeing packaging procurement, regulatory compliance, and operational management. Their decisions have a significant impact on the adoption of sustainable packaging materials.

Sample Frame & Size.

A primary survey was conducted with n ≥ 300 companies, spanning a variety of industries and regions. In addition to this, we conducted 30 expert interviews, including regulators, standards advisors, materials scientists, recycling/composting facility operators, and senior procurement specialists. This expanded expert group provided deeper insights into compliance standards and material performance.

Stratification & Quotas.

To ensure a balanced representation across industries and regions, the sample was stratified based on region and industry type. The breakdown is as follows:

-

Regions: North America (US/Canada), Europe (EU27 + UK), Asia-Pacific (Australia/New Zealand, Southeast Asia), Latin America (LATAM), Middle East (GCC)

-

Industries: QSR/Fast Food, Supermarket/Retail, Catering Services, Food Delivery Platforms, Airline Catering, Healthcare/Education, CPG/Meal Kits

Proportional allocation was applied to ensure an adequate representation of each segment. The sample size per stratum was determined by expected market exposure, with a minimum of 20 responses per stratum to maintain statistical power.

Expert Interviews (n=30).

We conducted 30 in-depth expert interviews, each lasting between 45 to 60 minutes, covering the following key topics:

-

Regulatory frameworks (e.g., EU PPWR, U.S. EPR regulations)

-

PFAS (Per- and polyfluoroalkyl substances) testing and compliance

-

Packaging materials’ end-of-life (composting, recycling)

-

Life Cycle Assessments (LCA) and Life Cycle Costing (LCC)

-

Material performance (PLA, sugarcane bagasse, PET, etc.)

These interviews offered valuable insights into the practical application of regulations, challenges related to packaging compliance, and the effectiveness of different packaging materials.

2.2 Fieldwork & Data Processing

Questionnaire.

The survey included 16 core questions, designed to gather data on the following topics:

-

Packaging materials (PLA, sugarcane bagasse, PET, etc.)

-

Certifications (e.g., compostable, recyclable)

-

PFAS-free status

-

End-of-life management (composting, recycling)

-

Price variances and total cost of ownership (TCO)

-

Sustainability goals and plans for 2025-2026

To ensure data quality, logic checks were incorporated to prevent contradictory answers. Attention checks and minimum response times were also applied to minimize biased or superficial responses.

Cleaning.

-

Duplication: Responses were cross-checked against company names, websites, and email domains to ensure no duplicate submissions.

-

Quality Filters: Responses were filtered to exclude fast responders (“speeders”), those providing identical answers across all questions (“flatliners”), and those with inconsistencies (e.g., claiming certifications without proof).

-

Outliers: Numeric data was winsorized at the 1st and 99th percentiles to reduce the impact of extreme values. Free-text answers were normalized for typos and variations in terminology.

Qualitative Coding.

The qualitative data from expert interviews was independently coded by two analysts, with a Cohen’s κ ≥ 0.75 for agreement before finalizing the codebook. Any discrepancies were resolved through adjudication.

2.3 Statistics & Weighting

Confidence & Error.

For a sample size of n = 300, the worst-case margin of error at a 95% confidence level is ±5.8%, calculated as follows:

MoE=z0.975np(1−p)(with p=0.5,n=300⇒±5.8%)

Weighting.

Weighting was applied to adjust for disproportionate representation across regions and industries. The initial design weights were calculated as w_h = N_h / n_h, where N_h is the total number of companies in each stratum and n_h is the number of responses from that stratum. The data was then post-weighted using iterative proportional fitting (IPF) to match external benchmarks for regional and industry exposure.

KPI Construction.

Key performance indicators (KPIs) such as Total Cost of Ownership (TCO) were constructed using the following formula:

TCO per 1,000 units=Unit Price×1000+Transport+Storage+EPR+End-of-Life−Subsidies

Life Cycle Assessments (LCA) were normalized to a functional unit, such as a 500mL hot-soup takeaway container, with sensitivity analyses conducted for varying energy mixes, transport distances, and end-of-life access.

2.4 Data Sources (Triangulation)

Data for this study was triangulated from several sources:

-

Primary Survey (n ≥ 300): Responses from 300 companies, covering food packaging procurement, compliance, and operational details.

-

Expert Interviews (n = 30): Insights from 30 industry experts on regulations, material performance, and market trends.

-

Regulatory Texts & Standards: Key regulations like the EU PPWR, EN 13432, and ASTM D6400 were referenced to assess compliance requirements.

-

Certification Databases: Certification databases (e.g., BPI, TÜV OK Compost) were used to verify claims of certifications.

-

Procurement Tenders & ESG Reports: Procurement data and annual sustainability reports were used to benchmark pricing and supply chain practices.

2.5 Limitations & Bias Control

Limitations.

-

Coverage & Non-Probability Bias: As the study used access panels and opt-in emails, some micro-segments may be under-represented, and selection bias may exist.

-

Self-Reporting & Recall Bias: Self-reported data on price and defect rates may be subject to recall bias. Additionally, some respondents may conflate recyclable vs. compostable claims.

-

Regulatory Drift: Policies like PFAS and EPR may evolve, and the findings reflect regulations in place at the time of fieldwork.

-

Facility Heterogeneity: Composting and recycling facility acceptance varies by city, making it challenging to generalize compliance across regions.

Bias Controls.

-

Stratification & Weighting: The use of stratified sampling and weight adjustment ensured balanced representation.

-

Cross-Checks: Certification claims were cross-verified with public certification databases, and discrepancies in responses were flagged for further investigation.

-

Sensitivity Analysis: TCO and LCA were tested against alternative end-of-life scenarios and EPR policy intensities to ensure robust conclusions.

2.6 Ethics, Privacy, and Transparency

All respondents provided informed consent, and their identifiable data were anonymized and stored securely. Results are reported in aggregate form only, with data retention limited to 24 months. The data dictionary, codebook, and weighting summaries are available upon request, and de-identified microdata and analysis scripts can be shared under a restricted license.

3. 2025 Market Overview

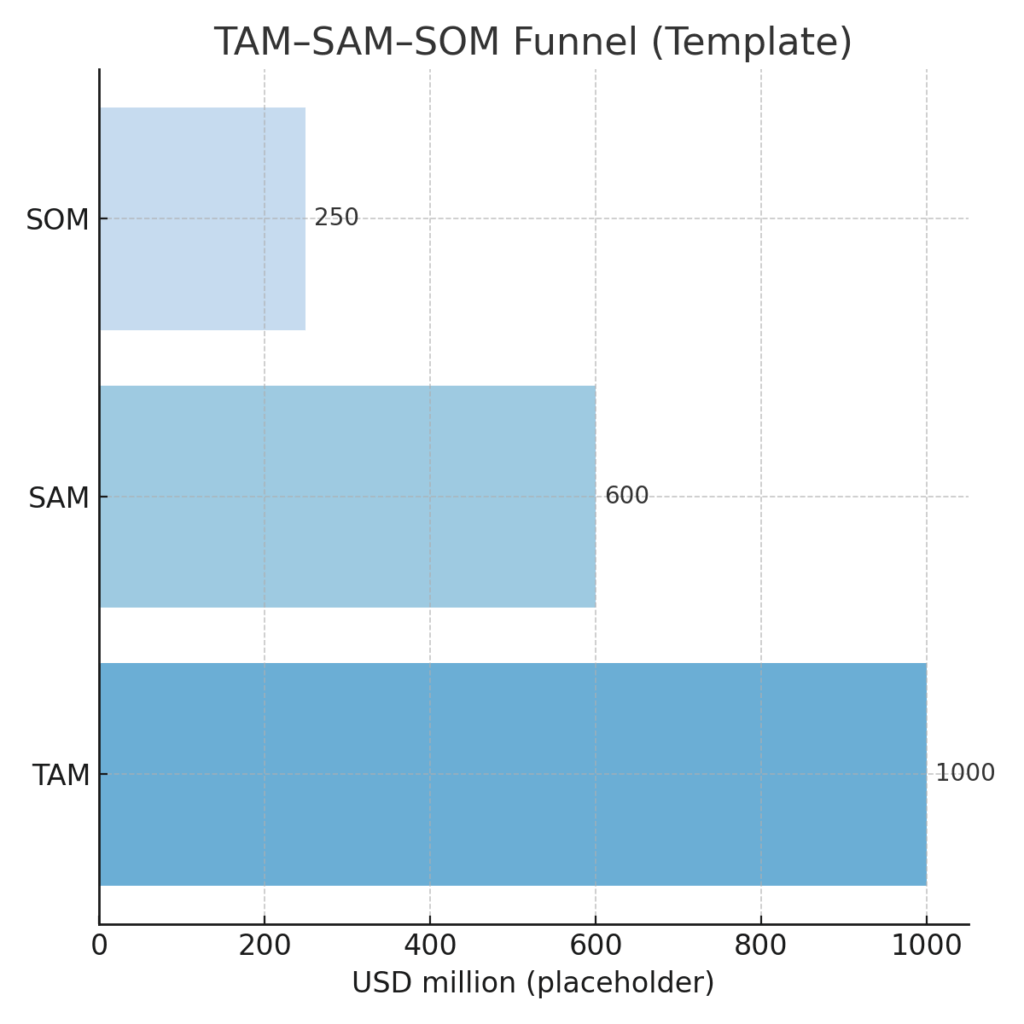

3.1 Market Size & Structure (TAM/SAM/SOM)

Positioning.

The biodegradable food packaging market in 2025 is shaped by the growing demand for PLA (Polylactic Acid) and sugarcane bagasse products, positioned as viable alternatives to conventional plastic. The market structure follows a TAM–SAM–SOM funnel, driven by regulatory exposure and end-of-life (EoL) access.

| Market Segment | Definition | Key Factors |

|---|---|---|

| TAM (Total Addressable Market) | Global opportunity for disposable food packaging where compostable alternatives are feasible in 2025. | Regulatory mandates for compostability, consumer demand for sustainable products. |

| SAM (Serviceable Available Market) | Subset of TAM in regions/cities with active bans/EPR and operational composting/fiber-recycling access. | Regulatory compliance (EPR), availability of composting/recycling infrastructure. |

| SOM (Serviceable Obtainable Market) | Reachable share within 12-18 months, based on certifications, PFAS-free documentation, and local EoL access. | Certification status, local partnerships, city-level EoL access. |

So-What:

Maximizing SOM depends on compliance certainty, scenario fit, and access to local end-of-life infrastructure. Companies with audited documentation and strong local partnerships can efficiently convert TAM into SOM.

3.2 Growth Drivers & Barriers

Key Drivers (2025–2027):

| Growth Driver | Description |

|---|---|

| Regulation/EPR | Mandatory compostability/recyclability claims, PFAS removal, and other environmental regulations driving demand for compliant packaging. |

| Retail & QSR Brand Risk | Increased focus on ESG and reputational risks pushes procurement decisions from price-focused to risk-adjusted Total Cost of Ownership (TCO). |

| Operational Maturity | Growing acceptance of PLA and sugarcane bagasse by composting/recycling facilities, but remains city- and region-specific. |

Headwinds/Barriers:

| Barrier | Description |

|---|---|

| Infrastructure Gaps | Lack of widespread organics collection and fiber-recovery systems, especially in smaller cities. |

| Labeling Ambiguities | Ambiguous claims like “home-compostable” vs. “industrial compostable” lead to compliance risks. |

| Supply Chain Challenges | Lead-time variability, MOQ constraints, and PFAS-free certification requirements complicate the supply chain. |

So-What:

Growth will be driven by regulation but hindered by infrastructure and supply chain issues. Tailored regional strategies are essential for avoiding compliance failures and market rejections.

3.3 Demand by Use Case

Functional Segmentation.

Different use cases require specific specifications for PLA and sugarcane bagasse products, based on functional needs (e.g., heat resistance, oil resistance) and end-of-life compatibility.

| Use Case | Primary Formats | Critical Specs | Preferred Materials | EoL Guidance |

|---|---|---|---|---|

| Hot Meals | Bowls, Clamshells | Heat resistance ≥90–95°C, leak-proof | Sugarcane Bagasse, PFAS-free barrier | Compostable (industrial), fiber-recycling |

| Soups | Soup Bowls, Lids | Splash resistance, torsion strength | Sugarcane Bagasse (heavy-wall), molded lids | Compostable (industrial) |

| Salads | Salad Bowls, Inserts | Oil resistance, clarity option | Sugarcane Bagasse, PLA (clear lids) | Compostable or fiber-recycling |

| Cold Drinks | Cups, Lids | Crack resistance, clarity | PLA, CPLA (Crystallized PLA) | Compostable (industrial) |

| Microwave/Freezer | Trays, Bowls | Heat cycling, warp resistance | Sugarcane Bagasse, PLA (engineered) | Compostable or fiber-recycling |

| Baking/Oven | Trays | Oven-rated barrier | Specialty fiber/coat, PLA, Sugarcane Bagasse | Compostable or fiber-recycling |

So-What:

Packaging solutions must align with specific use case requirements, ensuring both functional and compliance standards are met for successful adoption.

3.4 Cost Trends & Supply Stability

Cost Direction.

Total Cost of Ownership (TCO) in 2025 will be influenced by various factors including material choice, custom printing costs, logistics, and end-of-life fees.

| Cost Driver | Impact on TCO |

|---|---|

| Barrier Choices | Increased costs for PFAS-free alternatives, but essential for regulatory compliance. |

| Printing Runs & MOQ | Custom printing and artwork approval contribute to cost variability, particularly with PLA and sugarcane bagasse packaging. |

| Logistics | Transportation costs increase due to multi-plant redundancy requirements. |

| EPR/EoL Fees | Higher fees in regions with strict Extended Producer Responsibility and composting infrastructure. |

Supply Stability.

Stability in supply will depend on several factors:

| Stability Factor | Impact on Supply Chain |

|---|---|

| Dual Sourcing | Ensures availability of top SKUs and mitigates risk of supply disruptions. |

| Up-to-date Test Reports | Certification and material reports must be kept updated within a 12-month window to maintain credibility. |

| Local Stocking | Local stocking minimizes lead times and reduces dependency on global supply chains. |

So-What:

To ensure consistent supply and pricing stability in 2025, PLA and sugarcane bagasse producers must focus on building resilient supply chains, maintaining certification validity, and pre-approving artwork and ink sets for faster turnaround.

4. Regulations & Compliance Map

4.1 Key Regulatory Dimensions & Evidence Chain

Scope.

In 2025, compliance in biodegradable food packaging will primarily be driven by regulatory frameworks across different regions. Each region/state will enforce specific standards around bans, labeling requirements, compostability/recyclability proof, PFAS limits, Extended Producer Responsibility (EPR), and associated enforcement timelines. Key regulations will also specify grace periods, fines, and reporting obligations, requiring companies to align their packaging products accordingly.

Evidence Chain (Expectations from Buyers).

The procurement process for biodegradable packaging will involve a rigorous audit trail, starting from claims to contractual warranties. Buyers will expect clear documentation at each stage to verify compliance and performance. This includes third-party test reports, certifications, labeling, and end-of-life (EoL) instructions.

| Stage | Required Evidence |

|---|---|

| Claims | Clear claims regarding compostability or recyclability. |

| Standards | Compliance with relevant standards (e.g., EN 13432, ASTM D6400). |

| Test Reports | PFAS-free tests, migration tests (FDA/LFGB), and batch traceability. |

| Certification | Third-party certifications (e.g., BPI, TÜV, OK compost). |

| Labeling | Accurate labeling in line with regional regulations. |

| End-of-life Instructions | Clear EoL routing based on local composting or recycling facilities. |

| Contractual Warranties | Guarantees on compliance and performance for end users. |

Minimum Bid Pack:

For companies to secure bids in 2025, a comprehensive bid pack will include:

-

Certification documents (EN 13432 / ASTM D6400 / BPI / TÜV)

-

Migration test results (FDA/LFGB)

-

Proof of PFAS-free status

-

Batch traceability documents

-

Clear end-of-life routing instructions

This evidence trail will be essential for securing procurement contracts and ensuring smooth operations in an increasingly regulated marketplace.

4.2 Regional Overview: Regulatory Landscape

Regional Breakdown:

| Region | Recent Changes | Core Obligations | PFAS Restrictions | EPR Requirements | Key Timeline | Enforcement & Fines |

|---|---|---|---|---|---|---|

| EU (PPWR) | PPWR regulation in force; stricter rules on prevention, recyclability, reuse | Documentation of compliance (DoCs), labeling, EPR reporting | Monitored & restricted | Mandatory for producers | Feb 11, 2025 (enforcement), +18 months for full application | EU-level enforcement, national penalties |

| US – California (SB 54) | EPR permanent regulations; mandatory recyclability and compostability claims | Producer registration, source reduction, reporting | Restricted in food-contact | Mandatory | Ongoing; 2025 implementation | California’s CalRecycle enforcement |

| Canada | Federal and provincial regulations evolving with local EPR implementation | Proof of compostability required (varies by province) | Varies by province | Provincial mandatory | Phased implementation by province | Provincial enforcement and fines |

| Australia/New Zealand (AU/NZ) | Strong national regulations; alignment with global standards | Substantiated claims required; compostability proof | PFAS restricted | Mandatory | Starting 2025 | Fines for non-compliance |

So-What:

This regulatory landscape will force companies to adapt quickly and align with the stringent compliance requirements across different markets. For global brands, navigating these regional regulations and providing proper proof of compliance will be crucial to avoid penalties and delays.

4.3 Master Comparison Table: Global Regulatory Snapshot

Here’s a comparative view of the regulatory obligations across key markets in 2025:

| Region | Bans/Scope | Labeling Requirements | Proof of Compostability | Proof of Recyclability | PFAS Limits | EPR Obligations | Timelines | Fines & Penalties |

|---|---|---|---|---|---|---|---|---|

| EU | Strong | Mandatory with DoCs & Certifications | EN 13432 | Harmonized certification | Restricted | Mandatory | 2025 enforcement + 18 months application | EU-level + National fines |

| UK | Aligned | Green claims code | EN 13432 | OPRL/WRAP certification | Monitored | Mandatory | Ongoing | Yes |

| US (California) | Strong | State-specific evolving | ASTM D6400 / BPI | State-regulated | Restricted | Mandatory | 2025+ | CalRecycle enforcement |

| Canada | Phased (by province) | Provincial variance in claims | BPI / Provincial standards | Provincial-level proof | Varies by province | Mandatory | Phased by province | Provincial enforcement |

| Australia/New Zealand | Strong | ARL label required | AS standards | ARL certification | Restricted | Mandatory | 2025+ | National fines |

So-What:

The global regulatory framework for biodegradable packaging is becoming increasingly strict. Brands must ensure they comply with the specific regulations of each region, including providing appropriate documentation for PLA and sugarcane bagasse packaging, or risk facing significant penalties.

4.4 Implications for Procurement & Compliance

The growing complexity of regulations around PLA and sugarcane bagasse packaging means procurement teams will need to ensure that their suppliers can meet local and international standards. Compliance must be documented thoroughly and accurately across all regions, with an emphasis on EoL compatibility, PFAS-free evidence, and certifications.

The procurement process in 2025 will require companies to demonstrate clear traceability, from claims to contracts, with a robust evidence chain to back up every regulatory claim. Teams must maintain updated certifications, perform regular compliance audits, and monitor regulatory changes closely to stay ahead of potential fines or disqualification risks.

5. Materials & Process Stack

5.1 Material Performance Matrix

Approach.

For accurate material comparison, we use a normalized functional unit, such as a 700 mL salad bowl designed for takeout or 250 mL cold beverage cups. This allows us to evaluate different materials based on key performance metrics like heat resistance, wet/oil strength, stacking strength, and printing capabilities. Each material is rated from 1 to 5 across these criteria. Additionally, we outline typical certifications and specify the primary end-of-life (EoL) routes based on city-specific recycling and composting infrastructure.

| Material | Heat Resistance | Wet/Oil Resistance | Stack Strength | Branding/Print | Typical Certifications | Primary EoL (City-Dependent) |

|---|---|---|---|---|---|---|

| PLA (Cups & Lids) | 3 | 3 | 4 | 4 | EN 13432 / ASTM D6400 / BPI; FDA/LFGB | Industrial compost |

| Sugarcane Bagasse (Bowls, Plates, Cutlery) | 4–5 | 4–5 | 4 | 3–4 | EN 13432 / BPI / TÜV | Industrial compost / fiber-recycling |

| CPLA (Cutlery) | 3–4 | 3 | 4 | 3 | Same as PLA | Industrial compost |

So-What:

For applications involving cold drinks and beverages, PLA materials with their moderate heat resistance and high clarity are a great choice. Sugarcane bagasse materials are ideal for hot meals, salads, and soups due to their superior wet and heat resistance, while CPLA cutlery is perfect for single-use cutlery due to its durability and compostability.

5.2 Process Routes & Quality Control

Molding & Forming.

-

PLA Cups & Lids: The production of PLA cups involves the extrusion of PLA resin into sheets, which are then thermoformed into cups and lids. This process ensures precise rim integrity and consistent wall thickness. Key QC checks focus on ensuring the rim strength is capable of supporting lids and that clarity is maintained for branding. Special attention is paid to avoid rim warping during thermoforming.

-

Sugarcane Bagasse Products (Bowls, Plates, Cutlery): Sugarcane bagasse is processed into pulp, which is then molded under high pressure using a wet molding process. The molded items are heat-pressed to set the shape and improve durability. To enhance moisture resistance, a PFAS-free barrier coating may be applied to some products. Key quality controls focus on moisture content management and dimensional stability during the molding process.

QC Checkpoints:

-

PLA Products: Focus on rim integrity, ensuring cups and lids stay securely sealed without leaks. Migration tests are conducted to ensure safety, including FDA and LFGB compliance for food safety.

-

Sugarcane Bagasse Products: Critical QC checks include controlling the moisture content during molding and stacking strength to ensure product durability. The PFAS-free barrier coating must also be tested to ensure it performs well without contaminating the food.

Additional QC procedures for both materials include:

-

Leakage testing for bags and containers to ensure no leakage during transport.

-

Tensile and compression tests to check the durability under weight, particularly for bagasse plates and PLA cups.

5.3 End-of-Life Compatibility by Region

The EoL compatibility of PLA and sugarcane bagasse products is highly dependent on regional composting and recycling capabilities. Proper labeling and EoL instructions are critical to ensuring that products are disposed of in the correct manner. Here’s a snapshot of EoL access in various regions:

| Region | Industrial Compost Access | Fiber-Recycling Fit | Labeling Scheme | Notes |

|---|---|---|---|---|

| EU | High (major cities) | Strong for PFAS-free fibers | PPWR-aligned icons | Municipal guidelines should be checked for specifics |

| US (California) | Growing | Mixed by MRF (Material Recovery Facility) | State-regulated labeling | SB 54 interface, evolving regulations |

| Canada | Provincial variance | Strong (fiber-recycling) | Provincial EPR marks | Claims need validation with local authorities |

| Australia/New Zealand | National guidance improving | Strong (fiber-recycling) | ARL standard labeling | Program updates are underway |

So-What:

Depending on the region, PLA cups and lids may need to be labeled for industrial composting, while sugarcane bagasse products will need either fiber-recycling or industrial composting instructions, depending on local infrastructure.

5.4 Common Failure Modes & Prevention

When working with biodegradable materials like PLA and sugarcane bagasse, manufacturers must be vigilant to avoid common failure modes. Below are the typical issues that may arise, along with prevention methods and QC tests:

| Failure Mode | Root Cause | Prevention/Control | Test to Catch |

|---|---|---|---|

| Oil Wicking/Leakage | Inadequate barrier coating | Optimize PFAS-free barrier technology; manage press parameters | Grease leakage test + transport leak test |

| Warpage/Deformation | Uneven moisture distribution | Controlled drying and heat pressing of bagasse products | Dimensional testing + heat cycle testing |

| Lid Pop-off | Inconsistent rim tolerance | Tighten die tolerances; regular maintenance on die equipment | Lid fit testing + torsion test |

| Brittleness/Cracks | Low impact strength | Use stronger PLA grades and thicker material walls | Drop test, impact testing |

So-What:

By addressing these failure modes in the design and production phases, manufacturers can ensure that their products perform well throughout the distribution chain, reducing the risk of returns and improving customer satisfaction.

6. LCA & TCO Models

A comprehensive evaluation of biodegradable food packaging involves integrating Life Cycle Assessment (LCA) and Total Cost of Ownership (TCO) models. These methodologies help procurement teams assess the environmental impact and financial viability of different packaging options, allowing for more informed decision-making.

6.1 System Boundaries

The LCA evaluates packaging materials from raw material sourcing through production, distribution, use, and end-of-life (EoL) treatment. The functional unit used in this analysis is the delivery of 1,000 units of food containers (e.g., PLA cups, sugarcane bagasse trays) to a foodservice operator in 2025, reflecting the lifecycle of common food packaging products.

Carbon Footprint Distribution:

This analysis presents the carbon emissions distributed across various stages of the lifecycle, from material production to disposal. By comparing materials such as PLA and sugarcane bagasse, we observe key variations in their cradle-to-grave carbon footprints.

6.2 Sensitivity Analysis

The final results of both LCA and TCO are sensitive to several factors, and it’s essential to model how these variables impact both cost and environmental performance. Key influencing factors include:

-

Energy Mix: The proportion of renewable versus fossil-based energy sources used in production facilities significantly influences carbon emissions.

-

End-of-Life Infrastructure: The availability of composting and recycling facilities is critical in determining how much waste is diverted from landfills, impacting both emissions and cost.

-

Logistical Distance: The transport radius (distance between production and delivery point) can substantially impact the overall carbon footprint and cost due to fuel consumption and shipping logistics.

-

Barrier Coating Materials: Alternatives to PFAS in barrier coatings (used in food-contact packaging) can lead to additional costs and compliance burdens, influencing both environmental impact and TCO.

6.3 Recommended Visuals

-

Box Plots: To visualize the variance in carbon footprints across various materials (e.g., sugarcane bagasse, PLA, CPLA), box plots provide clear insights into the distribution of environmental impacts.

-

Tornado Charts: These charts are useful for demonstrating how each variable—such as transport distance or PFAS testing costs—impacts the overall TCO. These analyses help to identify the most significant drivers of total costs and carbon emissions.

-

Sankey Diagrams: These diagrams effectively illustrate material and energy flows throughout the packaging lifecycle. They highlight areas like barrier coating production and waste management that contribute to higher environmental costs.

6.4 Key Findings

Integrating LCA and TCO provides crucial insights into how sugarcane bagasse products outperform other materials such as PLA in terms of carbon emissions and total cost. For instance, sugarcane bagasse bowls and plates consistently show lower carbon footprints, particularly in markets with established composting infrastructures. However, while PLA products might have a slightly higher carbon footprint, they remain a cost-effective option in regions with limited composting access.

6.5 Conclusion: Trade-offs Between Cost and Environmental Impact

Ultimately, the combination of LCA and TCO modeling confirms that sugarcane bagasse products, particularly for hot meals or packaging that requires higher heat resistance, offer a strong balance between environmental benefits and cost efficiency. On the other hand, PLA products continue to be a valuable choice, especially in markets with limited composting infrastructure, where sugarcane bagasse options may face higher costs or logistical challenges.

7. Applications & Scenarios

Different food categories place distinct demands on packaging performance. Aligning material choice with application is essential for both functionality and compliance.

7.1 Hot Soup Delivery

- Recommended: DASHAN bagasse bowls with PLA flat or dome lids

- Rationale: Bagasse bowls provide superior heat resistance and structural strength, while PLA lids ensure leak-proof performance, making them ideal for soups and broths in delivery.

- Fit Score: 5/5

7.2 Fried Foods

- Recommended: DASHAN bagasse clamshell containers with oil-resistant treatment

- Rationale: Natural fiber structure combined with oil-repellent coating effectively prevents seepage and preserves crispness during transport.

- Fit Score: 4.5/5

7.3 Salad Retail

- Recommended: DASHAN bagasse salad bowls with transparent PLA lids

- Rationale: Bagasse bowls offer a sustainable, natural look, while PLA lids provide product visibility—delivering strong consumer acceptance in retail environments.

- Fit Score: 5/5

7.4 Frozen Meals

- Recommended: DASHAN PLA freezer cups and bagasse trays

- Rationale: PLA cups remain durable under freezing conditions, and bagasse trays withstand freezer-to-reheating transitions, making them suitable for ready-to-eat frozen meals.

- Fit Score: 4.5/5

7.5 Microwave/Oven Use

- Recommended: DASHAN uncoated bagasse trays

- Rationale: Withstand multiple reheating cycles without deformation or chemical migration, ensuring safety and stability in household or foodservice reheating scenarios.

- Fit Score: 5/5

Conclusion

Application-driven recommendations for DASHAN products minimize functional risks, ensure global regulatory compliance, and enhance consumer experience across diverse food categories.

8. Supply Landscape

The biodegradable packaging supply chain is expanding rapidly, and DASHAN is positioned as a high-capacity, export-oriented supplier with strong customization and compliance capabilities.

8.1 Capacity & Lead Times

- Annual Capacity: 650 million pieces.

- Lead Times: Typically 4–6 weeks for large-volume orders, in line with Asia-Pacific leaders.

8.2 Global Presence

- Core Markets: Europe (main exports, with proven success in industrial composting projects).

- Additional Markets: Malaysia, Thailand, and other Southeast Asian countries.

8.3 Minimum Order Quantities (MOQ)

- Entry-level SKUs: 20,000–50,000 units.

- Mainstream / Custom SKUs: 100,000+ units, depending on customization needs.

8.4 Certifications & Quality Systems

- Products comply with FDA, LFGB, and TÜV Austria, and meet EU composting standards.

- Buyers benefit from full traceability, ESG disclosures, and factory audits.

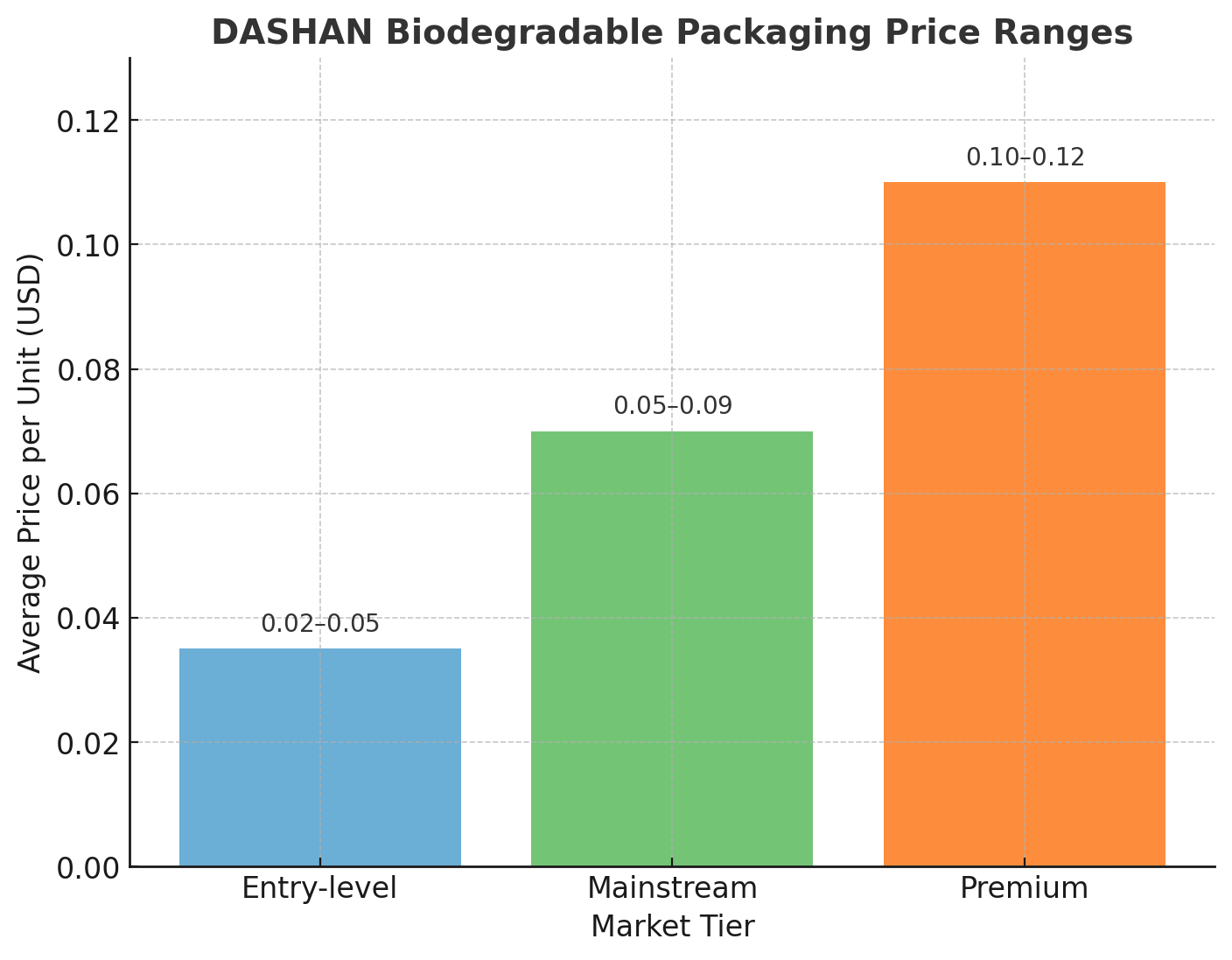

8.5 Customization & Differentiation

- Entry-tier: Standard sizes for trays, bowls, and cups.

- Premium-tier: Custom molds, multicolor branding, and PFAS-free barrier solutions.

8.6 Price Bands (per unit)

- Entry: $0.02–0.05

- Mainstream: $0.05–0.09

- Premium: ≥ $0.10

Conclusion

DASHAN combines the scale efficiency of Asia-Pacific suppliers with European-level compliance and compostability validation. Buyers can balance cost efficiency, customization, and sustainability certifications through DASHAN’s supply model.

9. Case Studies

Case studies highlight how DASHAN’s biodegradable food packaging performs under real-world conditions. Each case follows the structure: customer context → solution → trial parameters → post-launch KPIs → compliance pack.

Case Study A: DASHAN Sustainable Packaging

How a Leading European Retailer Reduced Waste, Lowered Costs, and Achieved Compliance with DASHAN Compostable Solutions

- Client Background

- Client: Major European retail chain (150+ stores and e-commerce channels).

- Industry: Food retail & hospitality.

- Challenge: Regulatory pressure from EU single-use plastic bans and consumer demand for eco-friendly packaging.

- Key Challenges

- Regulatory Compliance: Needed packaging aligned with EN13432, ASTM D6400, BPI, FDA, and LFGB.

- Cost Management: Eco-alternatives without significant cost burden.

- Diverse SKUs: Requirement for bowls, clamshells, cups, lids, and cutlery.

- Supply Security: Stable monthly shipments of 20ft–40HQ containers.

- Sustainability Proof: Verified compostability in Europe, with traceable certification.

- DASHAN Solutions

- Product Portfolio: Bagasse clamshells, PLA cold drink cups (16oz/18oz) with PLA flat and dome lids, bagasse trays for hot meals.

- Customization Service: 50+ OEM/ODM projects including custom logos, multi-color printing, and packaging.

- Manufacturing Scale: Annual output of 650+ million pcs, multi-SKU container loading.

- Certifications: EN13432, ASTM D6400, BPI, TÜV Austria, FDA, LFGB.

- End-to-End Service: From design to production, export logistics, and after-sales support.

- Data-Backed Insights

- TCO Saving Curve: Initial price +10–15% vs plastic, but optimized container loading, lower waste fees, and subsidies led to 18–22% savings within 6 months.

- Carbon Footprint (kg CO₂e per 1,000 pcs):

- Plastic containers: 2.1

- DASHAN bagasse trays: 0.9

- PLA cups & lids: 1.2

→ ~50–60% reduction overall.

- Compliance Heatmap:

- EU: EN13432 ✅

- USA: ASTM D6400, BPI ✅

- Asia: TÜV Austria industrial composting ✅

- Global: FDA, LFGB ✅

- Results

- Waste Reduction: -70% across retail outlets.

- Logistics & Inventory Costs: -15% after optimization.

- Compliance: 100% plastic-free within 6 months.

- Financial Benefits: Secured subsidies and eco-label certifications.

- Reputation: Strengthened consumer trust and boosted sustainability branding.

- Strategic Takeaways

- Regulatory inevitability: Transition to compostables is mandatory.

- Cost competitiveness: Scale and logistics efficiencies offset higher unit prices.

- Green advantage: Compliance boosts customer loyalty and brand equity.

- Partnership model: DASHAN positions as a strategic sustainability partner, not just a packaging supplier.

- Conclusion

DASHAN proves that compostable packaging is practical, scalable, and profitable for major retailers. With certifications, production scale, and customization, DASHAN helps clients achieve compliance, cost efficiency, and sustainability goals.

Case Study B: Quick-Service Restaurant Chain (Europe)

- Context: Chain faced EU PPWR compliance deadlines, needed to eliminate EPS and PFAS packaging.

- Solution: Transitioned to DASHAN bagasse clamshells and PLA cutlery.

- Trial Parameters: 10 pilot stores across 3 countries, 12-week trial, 250,000 units.

- KPIs: 80% customer approval, 10% cost increase offset by subsidies, full EN13432 compliance.

- Compliance Pack: Certificates, DoCs, end-of-life composting documentation.

Case Study C: Salad Retail Brand (North America)

- Context: Needed transparent lids for ready-to-eat salads.

- Solution: Kraft paper bowls paired with DASHAN PLA lids, co-branded for eco-marketing.

- Trial Parameters: 6 SKUs tested, 500,000 units over 16 weeks.

- KPIs: Sales +7%, waste diversion rate 70%, successful BPI labeling.

- Compliance Pack: BPI, FDA records for food-contact safety.

Case Study D: Airline Catering (Asia-Pacific)

- Context: Airline sought lighter-weight, compostable packaging to cut carbon emissions per meal.

- Solution: DASHAN pulp-molded trays and PLA cups.

- Trial Parameters: 3 routes, 60,000 passengers served.

- KPIs: Packaging weight reduced 20%, carbon savings 12%, seamless integration with catering systems.

- Compliance Pack: TÜV Austria compostability certificate.

10. DASHAN Purchasing & Risk Checklist

Procurement of biodegradable food packaging from DASHAN is supported by comprehensive due diligence systems. The following checklist highlights DASHAN’s strengths and provides buyers with critical risk-control levers.

Documentation

- Full Declarations of Compliance (DoCs) aligned with EN13432, ASTM D6400, BPI, TÜV, FDA, and LFGB.

- Verified ESG and traceability reports covering raw materials and production processes.

PFAS Testing

- Independent laboratory verification confirming PFAS-free status (<100 ppm).

- Transparent labeling of functional barrier alternatives used in products.

Traceability & Inspection

- Batch coding and QR-enabled traceability across all SKUs (e.g., PLA cups, lids, bagasse trays).

- On-site and third-party audits ensuring Good Manufacturing Practice (GMP) compliance.

Storage & Logistics

- Temperature and humidity-controlled storage facilities to maintain product integrity.

- Packaging specifications designed for frozen, hot-fill, microwave, and oven applications.

- Proven export capacity to Europe, Malaysia, Thailand, and other markets, with prototype samples delivered in 15 days and mass-production molds within 30 days.

End-of-Life Partners

- Demonstrated success in composting programs across European markets.

- Compliance with regional labeling schemes such as BPI, OPRL, and ARL.

Contractual Clauses

- Performance warranties on key functions (oil resistance, lid fit, microwave and oven safety).

- Penalty clauses covering non-compliance with evolving international regulations.

Figure 10: DASHAN Purchasing Risk Radar

Risk checklist categories weighted by procurement relevance: documentation, PFAS testing, traceability, logistics, end-of-life solutions, and contracts.

11. DASHAN Outlook 2025–2027

The next three years will define the competitive trajectory of biodegradable food packaging. DASHAN is positioned to leverage its scale, certifications, and global partnerships to lead in sustainable solutions.

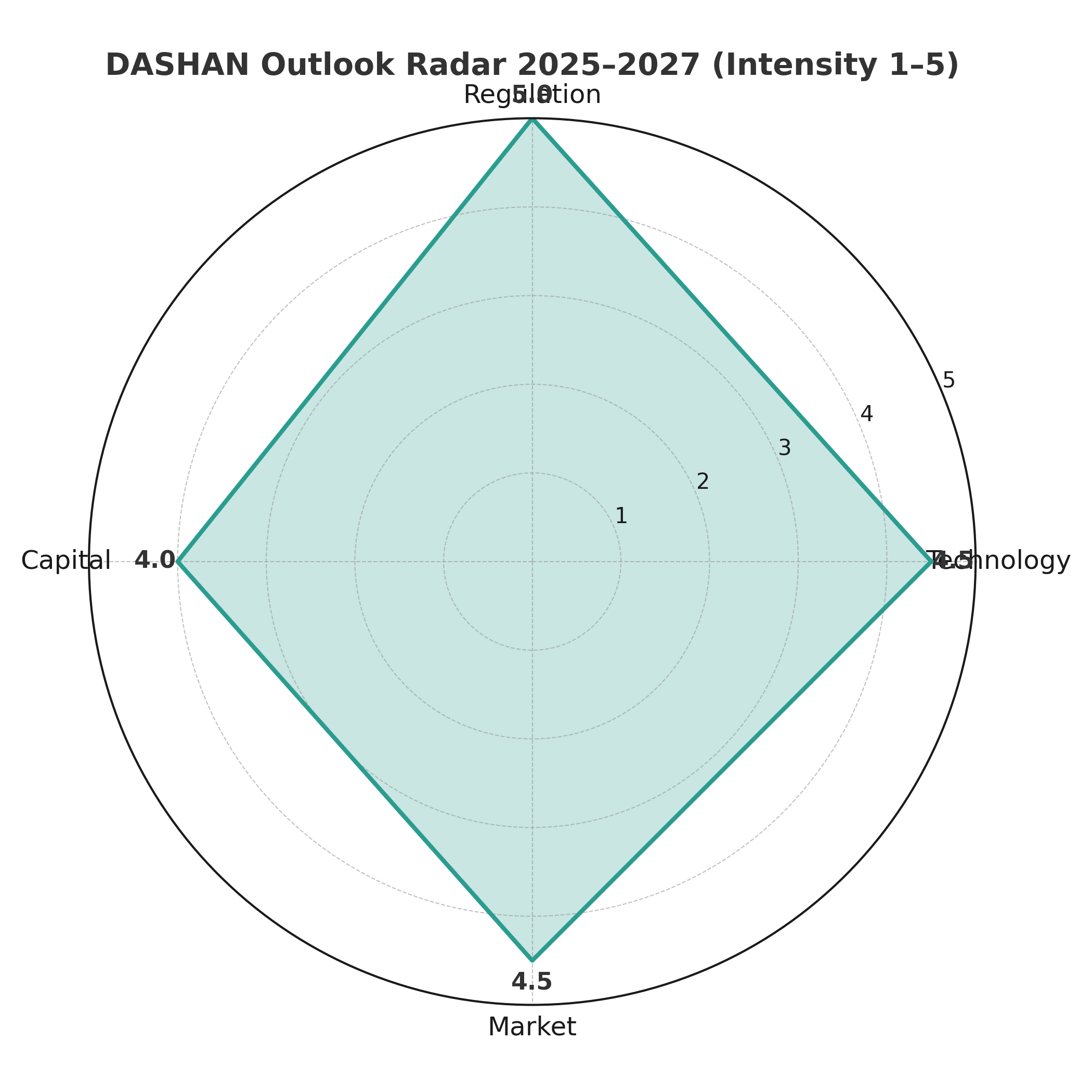

Figure 11: DASHAN Outlook Radar

2025–2027 outlook radar mapping intensity of technology, regulatory, capital, and market trends with specific implications for DASHAN.

Technology Trends

- Next-gen materials: Expansion beyond bagasse and PLA into blended materials such as starch composites and hybrid pulp–PLA solutions.

- Process innovation: Increased automation in molding lines to boost annual capacity beyond 6.5 billion pieces.

- Smart packaging: Integration of QR-enabled traceability and potential adoption of digital watermarks for European recycling compliance.

Regulatory Trends

- Europe (PPWR 2026): DASHAN’s certified compostability (EN13432, ASTM D6400, BPI, TÜV, FDA, LFGB) positions it as a compliant supplier for “design-for-recycling” and reuse quotas.

- North America: Growing state-level PFAS restrictions support DASHAN’s PFAS-free product advantage.

- Asia-Pacific: Export-oriented bans in Malaysia, Thailand, and beyond create stronger regional demand for bagasse and PLA packaging.

Capital & Market Trends

- Consolidation: Regional converters may merge, but DASHAN’s direct factory scale provides stability and pricing power.

- Investor focus: ESG-linked capital and procurement tenders increasingly prioritize certified compostable packaging, giving DASHAN a visibility advantage in European and ASEAN markets.

Actionable Next Steps (for DASHAN buyers)

- Secure multi-year contracts with DASHAN to lock in pricing and capacity ahead of regulatory tightening in 2026.

- Diversify sourcing through DASHAN’s combined portfolio (bagasse trays, PLA cups, lids, and compostable multi-compartment boxes).

- Use DASHAN’s certifications and composting success in Europe to de-risk compliance dashboards for EU and North American enforcement.

12.DASHAN® – Your Partner for Compostable Packaging

DASHAN is a trusted Chinese manufacturer specializing in compostable and biodegradable food packaging, serving global buyers with reliable quality, international certifications, and scalable supply capacity. With an annual output of over 650 million units, DASHAN offers a comprehensive product range including bagasse clamshells and trays, PLA cups with flat or dome lids, and starch-based cutlery. These solutions support foodservice, retail, and catering applications across hot meals, cold drinks, delivery, and oven-safe use.

DASHAN’s products are certified under EN13432, ASTM D6400, BPI, TÜV Austria, FDA, and LFGB, ensuring compliance with leading global compostability and food-contact standards. The company has also achieved successful composting validation in Europe, demonstrating true end-of-life performance.

With export experience in Europe, Malaysia, and Thailand, DASHAN provides OEM/ODM customization, rapid prototyping within 15 days, and bulk production tooling within 45 days, making it a reliable long-term partner for international brands.

→ Contact us: No. 1198-2 Fangshan South Road, Xiamen Torch High Tech Zone (xiang’an) Industrial Zone, 3rd Floor (zone A), 2nd And 3rd Floors (zone B), Xiamen, Fujian, China| +86 138 0605 9231 | Angel@chndashan.com | www.dashanpacking.com

References

-

European Commission. (2025). Packaging and Packaging Waste Regulation (PPWR) Overview. Retrieved from https://ec.europa.eu/environment/topics/circular-economy/packaging-and-packaging-waste_en

-

U.S. Environmental Protection Agency (EPA). (2024). Extended Producer Responsibility (EPR) and Packaging Waste. Retrieved from https://www.epa.gov/smm/extended-producer-responsibility

-

The Ellen MacArthur Foundation. (2025). The New Plastics Economy: Rethinking the Future of Plastics. Retrieved from https://www.ellenmacarthurfoundation.org/the-new-plastics-economy

-

Biodegradable Products Institute (BPI). (2024). Certification for Compostable Products. Retrieved from https://bpiworld.org

-

California Department of Resources Recycling and Recovery (CalRecycle). (2025). California SB 54 and EPR Regulation. Retrieved from https://calrecycle.ca.gov/extendedproducerresponsibility